Single Trip Car Insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is single trip car insurance?

If you're needing to insure a car for a single trip, then insurance for just one journey with Covertime could be the answer.

No matter how long the trip is, if it's between 1 hour and up to 28 days, you get to decide how long you need cover.

An insurance policy for a single trip could come in handy in cases such as an unexpected emergency, borrowing a friends car or a fun-filled weekend trip.

You can conveniently get comprehensive car insurance for just a single trip that won't affect your no claims discount, which is great news for those drivers that need to keep things flexible.

Driving a new car home before you sort an annual policy

Test driving a new car before you buy it

Driving a second car that you don't use very often

Driving a friend's or family member's car to help them out or for your own use

Sharing the drive on a long trip

Using a car in an emergency

Our policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

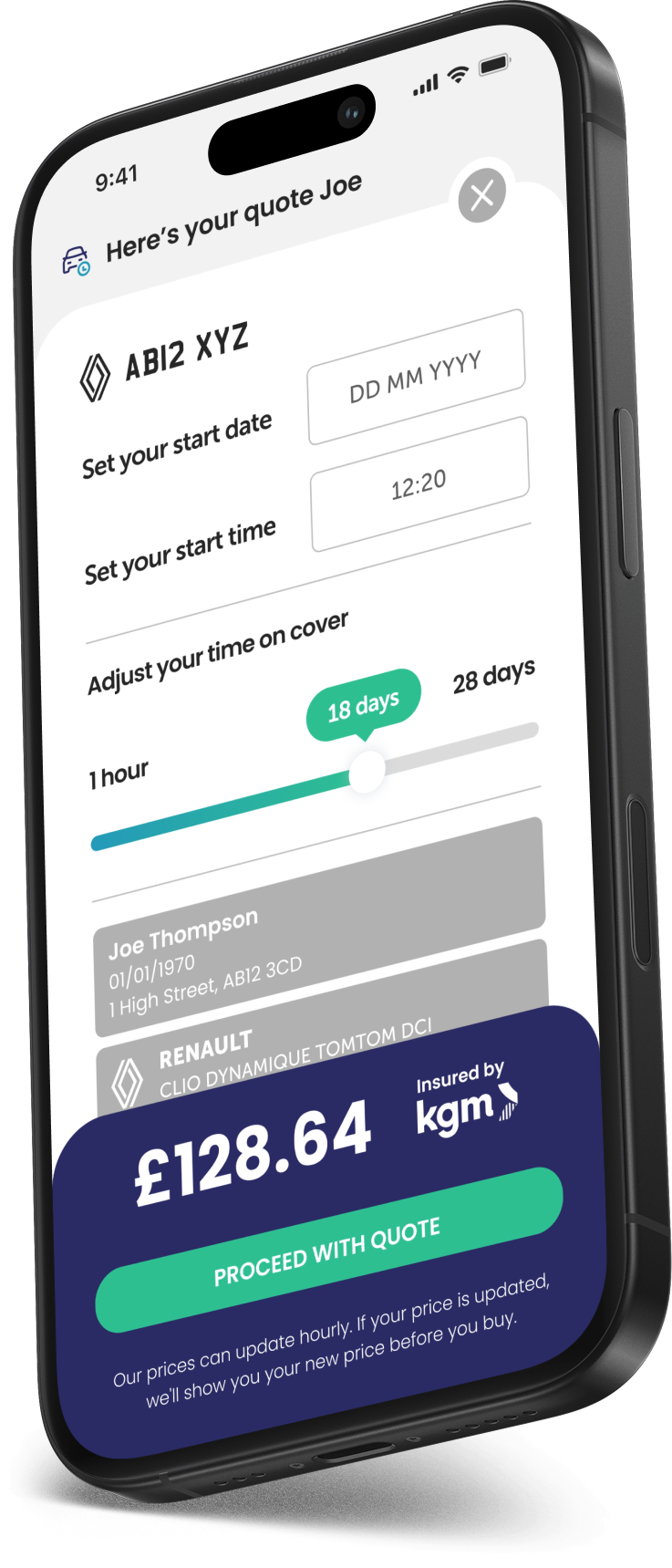

How to get insurance for a single journey

Need to get car insurance for a single trip but don't know where to start? You're in the right place and it's never been easier.

We've made getting a quote online as simple as possible- Covertime is proudly faff-free. We won't waste your time with long, overly complicated online forms. We only ask you the basic information that we need to get you covered and out on the road.

1

Let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs insurance for a single trip?

This type of short but mighty comprehensive insurance is for drivers who need car insurance for a single trip and don't want to pay for more than what they need. You might only need two or three days cover for your trip, this isn't a problem.

Whatever the reason - whether it's emergency, spontaneity or necessity - a short car insurance policy is a simple and quick way to make sure you have the cover you need.

Who is single trip car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does single car insurance cost?

The premium you will pay for your single trip car insurance will depend on things such as your age, experience, where you live, when you need cover, the car you'll drive and how long you need to drive it for.

If you only need to drive a car for a small amount of time, then a temporary car insurance policy might be an affordable option for you. However, the longer you need to insure yourself on the car for, the more it will cost.

You can buy multiple single trip insurance policies throughout the year, but at some point an annual car insurance will become more cost effective, if you're always using the same car.

How can you get the cheapest single trip car insurance?

The golden rule to get the cheapest single trip car insurance is: Only buy the cover for the time you need.

The beauty of single trip cover is that you can insure yourself at the exact time you need to start driving and set it to end when you need it to.

By only insuring yourself on the car for the time you need to drive it, you can keep your short term car cover costs to a minimum.

Choose from as little as one hour all the way up to 28 days. If you need more time after one policy ends, then you can take out new one trip car policies.

Benefits of single trip insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our one trip car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Single trip car insurance FAQs

Single trip insurance is completely flexible, not only does it allow you to drive the car of a family member or friend, it allows you to choose the exact amount of time you need to use the car for. Maybe it's only two days but you can insure a car for as little as one hour up to 28 days.

Yes, you absolutely can insure yourself on someone else’s car with single trip car insurance, that is one of the main reasons people get it. Just make sure you have the owner’s permission.

Yes you can take out multiple temporary policies in a year, but there will come a tipping point that it would make more sense cost-wise to take out an annual policy.

You have comprehensive cover as standard to drive in Great Britain and Northern Ireland, the Isle of Man, the islands of Guernsey, Jersey and Alderney.

All journeys must start and end in the UK however, if you do decide to travel a little further and you're driving inside the EU, you'll be covered for the minimum legal level required by law in that country. In the EU the minimum legal level is third party only (TPO), meaning damage to the car you are driving is not covered.

We are not able to cover countries outside of the EU.

You cannot legally drive a car home without insurance. If you have an accident you won't be insured and the excuse that it's a new car and you haven't had chance to insure it yet, wouldn't cut the mustard.

You can use single trip car insurance or drive away insurance as it can also be referred to, to get a new car insured. This way you can give yourself more time to find a competitive and suitable annual car insurance policy.

You need to have held your full UK driving licence for at least six months to get single trip short term cover. So, if you've just passed your test, congratulations, but you'll need to wait for six months before you can get a temporary car insurance policy.

Single trip cover is perfect for short term needs, but if you require coverage for a longer duration, an annual policy may be more cost effective.

It doesn't cover you for driving a rental or hired car; you'll need a specific hire car insurance policy for that.

Short term cover also is not suitable if you're planning on using it to be a cabbie - you'll need proper taxi insurance to do that. It's also not to be used for deliveries or courier work.

One trip car insurance is also not suitable for releasing a vehicle from a Police or Local Authority impound, learning to drive, driving outside of the EU/EEA and for importing / exporting cars; the vehicle must be in the UK at the start and end of the policy.

Did you know?

You can buy insurance for a single trip on any car, even one you don't own, but you must have the owner's permission!