Monthly learner insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Learner cover from one hour to 90 days!

Get on the road in minutes

Quick and flexible

What is monthly learner driver insurance?

Learning to drive in the UK and looking to fit in those crucial driving hours? A monthly learner driver policy could be a handy solution.

Monthly learner driver insurance gives you the opportunity to practice in someone else's car, outside of official lessons. Whether that's for one month or even up to 90 days of learner driver cover.

This cover is super handy for private practice and ensures you meet the legal requirement to have valid motor insurance while behind the wheel, and it's fully comprehensive, just like getting temporary car insurance with a full UK licence.

It's super useful for:

Flexible extra driving time on top of lessons

Learning to drive in a parent's or grandparent's car

Learning to drive in your own car

Boost your practice time to pass

Our monthly learner policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

How to get monthly learner driver insurance UK

Getting monthly learner insurance with Covertime is as simple as it gets!

You want to get out on the road, and we know that - which is why we've made sure it's as quick and easy as humanly possible to get a monthly learner driver insurance quote online.

You can get a quote in a flash with our super simple quote process, get that practice in pronto and on the road to passing your test with flying colours!

1

Let us know the vehicle reg and a few details about yourself

2

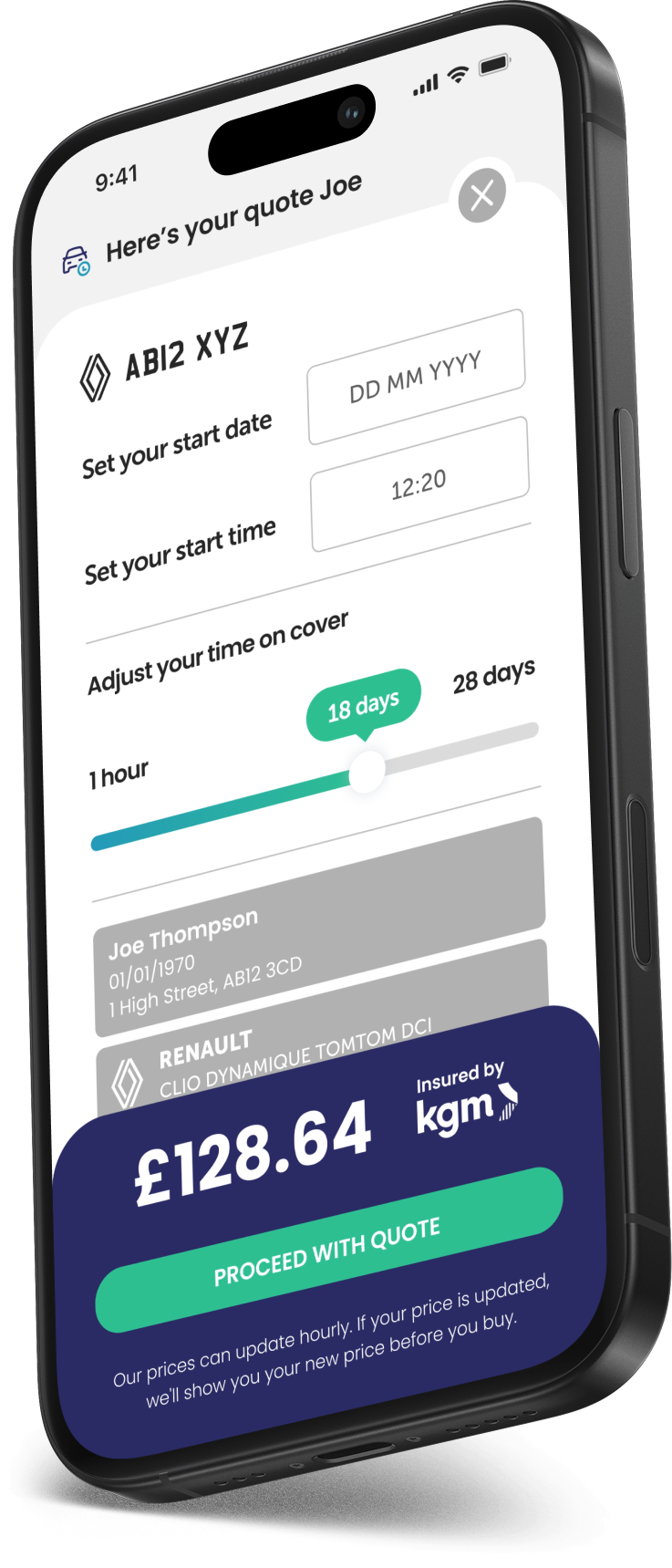

Then we need to know when you need the learner cover and how many hours

3

Get your quote, check the terms, choose how you want to pay and you're off!

Important info about learner driver insurance for a month

Our monthly learner driver policies are designed to cover you only while you’re learning to drive. It’s important to understand the conditions so you stay insured and avoid any issues:

Cover ends as soon as you pass: Once you pass your driving test, your insurance stops immediately, even if you're just driving home from the test centre. You're not covered to drive after that point.

Let us know straight away: You must inform us as soon as you pass your test. This is so the policy can be cancelled properly.

Don’t drive without valid cover: If you keep driving after passing your test without having a new policy in place, you could be prosecuted for driving without insurance which is not the way we want your

If you're not the car’s owner: The registered keeper of the car (whether it's a parent or grandparent) must have their own insurance policy in place. This learner driver policy won’t cover them, it only covers you as the learner.

If you’re unsure about anything in your policy or need to make changes, contact us for help. Full details about cancellations can be found in your policy wording.

Who is month by month learner driver insurance suitable for?

Personal use

Ages 17-75

Provisional UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does learner driver insurance cost monthly?

The cost of getting learner driver insurance by the month varies depending on factors such as your age, experience, where you live, when you need cover, the car you'll drive and exactly how long you need to drive it for.

Short term learner policies by the month can be very affordable if you just need to practice for an hour or two at a time. Our learner driver insurance can go all the way to 90 days, so longer policies will usually be more expensive.

Adding a learner to an existing policy as a named driver is another option, but if there is a claim it will effect the main policy. This is unlike learner driver insurance where it keeps claims separate and would not impact existing NCD of the car owner.

The premium you will pay for your temporary learner car insurance will depend on a number of factors determined by the insurers.

If you only need to drive a car for a small amount of time, such as hourly or daily, then a temporary car insurance policy might be an affordable option for you. However, the longer you need to insure yourself on the car for, the more it will cost.

You can buy multiple temporary car insurance policies throughout the year, but at some point an annual car insurance will become more cost effective, if you're always using the same car.

How can you get cheap monthly learner driver insurance in the UK?

The smart way to save on learner driver insurance? Only pay for the time you actually need, which is why getting covered for just a month could be a great flexible and cost-effective choice when you're learning to drive.

One of the biggest advantages of learner car insurance is that you can set it up to cover just the time you're behind the wheel. Whether you're squeezing in extra practice hour or two before your test or going out for a few weekend supervised drives, you’re in control.

By only insuring yourself on the car for the time you're driving it, you help to keep the cost down. Learning to drive can be expensive so being able to just pay for one month can help keep costs down.

You can choose cover by the hour from 1 hour, all the way up to 12 with hourly learner car insurance. If you need more time after a policy runs out, just take out another short term learner policy. It’s flexible and quick and simple to set up!

Keeping on the flexibility theme, when you pass your test, you’re not locked into anything. You can switch to a different type of policy that suits your new status as a qualified driver, without being tied into an annual deal you no longer need.

It’s the perfect option for learners who want affordable, no-commitment insurance that fits around lessons, private practice and test prep.

Monthly learner driver insurance specialists

Expert learner driver insurance by the month that fits around you...

At Covertime, we provide short term car insurance designed specifically for learner drivers across the UK. While our brand is new, our team brings decades of experience in temporary insurance.

We set out to make learner driver insurance faster, fairer, and simpler. Tired of the complicated processes elsewhere, we created a solution that fits around real lives, not paperwork.

Our flexible monthly learner insurance can be arranged in minutes, with cover ranging from just one hour up to 90 days. It’s perfect for extra practice before your test or covering lessons in between.

Getting started is simple. You can receive a quote in under a minute, choose the exact duration you need, and drive insured without affecting a parent or grandparent’s no claims bonus.

Everything is handled online, with no long forms or waiting on hold. If you need assistance, our friendly live chat team is ready to help. The best part is you only pay for the cover you actually use, with no long-term commitment.

We’ve removed unnecessary questions and jargon so arranging your short term learner insurance is quick and stress-free. Everything can be done on your phone or laptop, and confirmation is instant.

When you pass your driving test, simply end your learner policy and move on, free from annual contracts. Whether you’re using your own car or a family member’s, Covertime makes learner insurance straightforward, safe, and affordable.

Covertime is here to be your reliable choice for monthly learner driver insurance in the UK.

Month by month learner insurance

Takes less than 60 seconds!

Benefits of month-long learner driver insurance

More driving practice

Get extra time on the road outside of lessons, which can help you pass your test sooner.

Comprehensive cover

Our learner insurance protects you, your passengers, your car as well as other people, property and vehicles.

Flexibility

Choose how long you need cover for: days, weeks, or months.

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Can learner drivers get car insurance for a month?

Yes you can! If you’re practicing in a driving instructor’s car, the insurance is usually included in the cost of your lessons, but if you’re learning in your own vehicle or someone else’s, you’ll need a separate learner driver insurance policy to drive legally on public roads.

You can’t rely on the car owner's insurance unless you're added as a named driver and the policy explicitly covers learners. With Covertime you can insure yourself on a car you don't own for month to boost your practice time!

How do I know my car is insured when using learner insurance?

When you take out monthly learner driver insurance with Covertime, you can be confident you're properly and comprehensively insured. We work with a trusted panel of UK insurers who are super experienced in providing short term cover for learner drivers.

As soon as you buy your hourly policy, we’ll email you confirmation along with your official policy documents, including your Insurance Certificate. This confirms that you're legally covered to drive during your chosen period of practice.

You can also check the Motor Insurance Database (MID) – the UK’s central record of insured vehicles. However, because temporary learner insurance is designed to start quickly, your policy may not appear on the MID straight away. Don’t worry – as long as you’ve received your documents from us, you’re insured and safe to get behind the wheel.

Whether you're practicing for your test or building confidence with extra private lessons, your Covertime policy has you covered.

What levels of cover does monthly learner driver insurance have?

When you take out an annual car insurance policy, you’ll usually choose from three main levels of cover: Comprehensive, Third Party, Fire and Theft (TPFT), or Third Party Only (TPO); which is the minimum legal requirement for driving on UK roads.

Third Party Only covers damage or injury to other people, their vehicles or property but not your own. TPFT offers the same protection as TPO but also includes cover if your car is stolen or damaged by fire. Comprehensive cover goes further, including all the above plus protection for your own vehicle, even if an accident is your fault.

At Covertime, we only provide Comprehensive cover for learner drivers. It’s the most complete level of protection, which is ideal when you’re still learning and building confidence. It means that both you and the car you’re practising in are properly covered while you're on the road.

We keep things simple by giving you the best level of insurance from the start – no confusing options or compromises, just quality cover while you learn.

Pay securely and easily

Monthly learner car insurance FAQs

Yes, a learner driver can get insurance on their own car, as long as they have a valid UK provisional licence.

Learner car insurance allows you to practise in your own vehicle outside of lessons with an instructor, as long as you're supervised by someone who meets the DVSA requirements. It’s a good option if you plan to get plenty of private practice before your test. Some annual learner policies may also let you build up a no claims bonus.

You can take out learner driver insurance on your parents’ car. This is a popular choice for many provisional drivers.

The insurance is kept separate from your parents’ main policy, so if you have an accident, it won’t affect their no claims bonus. You’ll still need to make sure the car is insured by the registered keeper throughout, and you must always be supervised by a qualified driver when practising.

A learner driver needs valid car insurance that covers them while practising on public roads with a provisional licence. If you're taking lessons with an instructor, insurance is usually included.

But for private practice in your own or someone else’s car, you'll need learner driver insurance that meets UK legal requirements.

You can get learner car insurance with a provisional licence. Monthly learner driver insurance is specifically designed for provisional drivers and covers you for supervised driving practice before you pass your test.

Learner driver car insurance is a standalone policy, so you don’t need an existing or main insurance policy.

It's separate from the car owner's insurance, which means it won’t affect their no claims discount if you make a claim.

If you're supervising a learner in your own car, your vehicle must be insured for you to be legally on the road.

The learner also needs to be covered, either through their own learner driver policy or as a named driver on yours. If you're supervising in their car, you might not need insurance yourself, but the vehicle still must be insured.

There could be a few reasons why you’re unable to get learner driver insurance:

You're under the minimum age (usually 17)

The car is too powerful or high value for learner cover

You're trying to insure without a valid UK provisional licence

The supervising driver doesn't meet legal requirements

If you’re unsure, it’s worth checking the policy criteria or contacting a broker for help.

You can get learner driver car insurance by the hour with Covertime, from one hour up to 12 hours; it then can be purchased by the day, ideal for short practice sessions.

It’s a flexible and affordable option if you don’t need long term cover. We help you compare different durations so you can choose what's right for your needs. If you insure yourself for a few hours, but then need more time, simply take out a new policy for the time extension that suits you.

Once you pass your driving test, your learner driver insurance ends immediately. You're no longer covered, not even to drive home from the test centre.

You’ll need to arrange a new policy as a qualified driver before you drive again. Unfortunately due to insurer requirements, you will need to have held your full licence for six months to be able to buy a standard temporary insurance policy with us.

Learner driver insurance could be cheaper than insurance for new full licence holders, because you’re always supervised and driving under more controlled conditions.

However, there are many variables and prices can still differ based on your age, the car, and how long you need cover for.

If you're learning in your own car or a family member’s car, you can take out learner driver insurance and also book professional driving lessons separately.

If you're only using an instructor’s car, you likely won’t need your own policy, as insurance is usually included in the lesson cost.

The cost of insuring a 17 year old varies, but learner driver insurance can be an affordable option for a 17 year so enter your details in our quote journey to get an accurate price.

Yes, you can get learner driver insurance for 90 days. This is ideal if you need some more time to get your driving up to scratch!

90 day learner policies offer the same legal protection as shorter ones, as long as you're driving with a qualified supervisor and meet all the standard conditions. It's a flexible, affordable option if you need a few months to get things right.

With Covertime our learner driver car insurance can be for as little as one hour all the way or to a massive 90 days! Giving you plenty of time to practise and pass that test to get rid of your L plates and get on the road by yourself for the first time!

Yes you can get temporary insurance without a full UK licence, but you'd need a provisional licence and need to use our learner driver insurance.

Did you know?

With learner driver car insurance the cover will cease immediately after the driver passes their driving test. This is because they're no longer a learner driver and will need standard car insurance!