Monthly van insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Comprehensive van cover for a month

Docs available immediately after purchase

Quick and flexible

Cover from one hour to 28 days

Protect existing No Claims Discount

Do everything online

Insure only for the time you need

Get on the road in minutes

What is monthly van insurance?

Monthly van insurance means you can insure yourself to drive a van for up to 28 days.

This type of temporary van insurance is perfect for drivers who like to keep things flexible, whilst also enjoying comprehensive van cover when they need it.

You might finding yourself needing cover on a van you don't drive very often, or maybe you're renovating your house and need to move furniture and supplies around - whatever the reason, monthly van insurance is here to help.

With flexible, faff-free options you can drive with peace of mind, knowing you're protected for exactly the time you need.

Transporting large furniture or items

Moving house or helping someone else relocate

Business use including carriage of goods for that business

Emergency use if your van is off the road

Driving a friend's or family member's van

Home renovations & needing to move and pick up supplies

Our monthly van policies are Comprehensive

What is covered?

Damage to the van you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the van unlocked

Wear and tear or windscreen

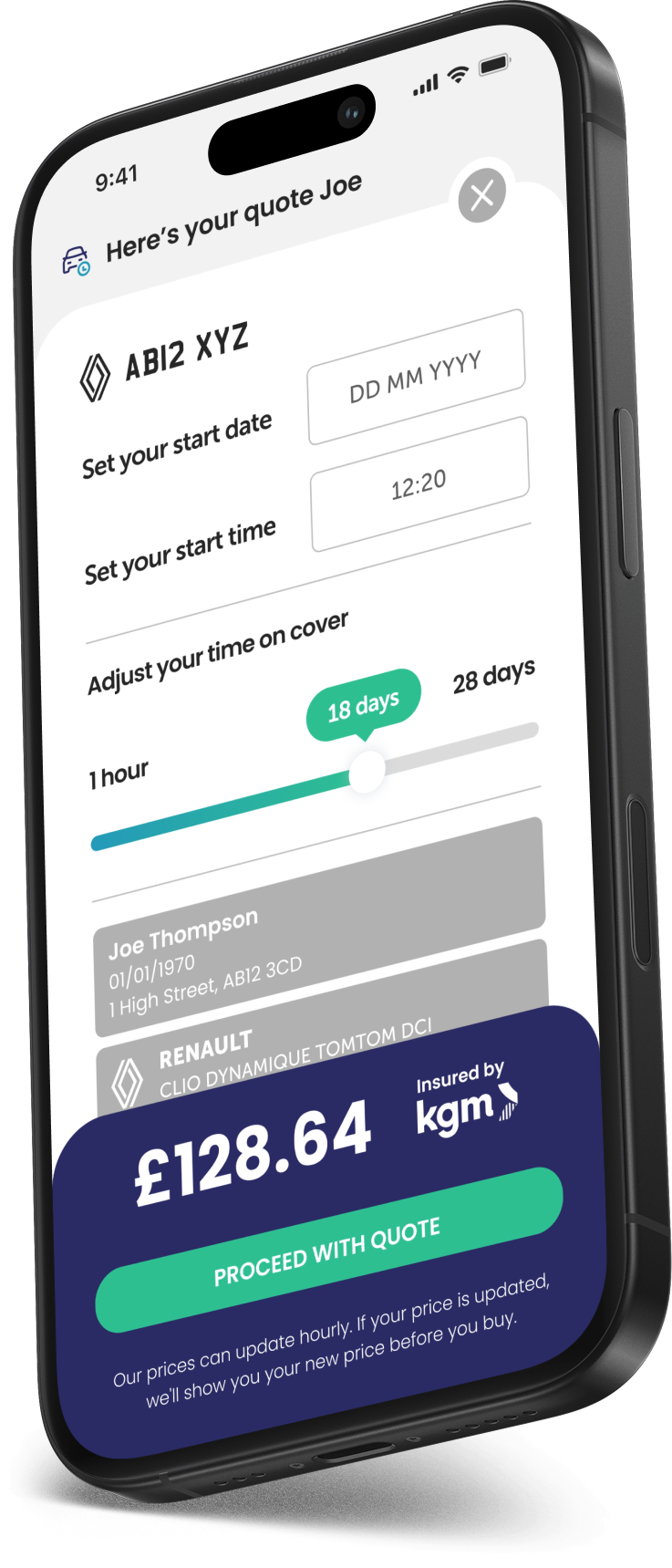

How to get monthly van insurance

The super handy thing about monthly van insurance is that it's very quick and easy to set up!

You can get a quote for monthly van insurance in a few minutes with our simple, easy to use quote process. Temporary van insurance gives you the protection you need, only for the time you actually need it...

Need cover to start ASAP? No problem; select that you’d like your cover to start right away when you're getting your quote online and it usually only takes a few minutes to get you set up and on the way.

If you’re super organised and are setting up weekend cover in advance, you can do this by selecting the exact date and time you’d like your cover to start up to 30 days in the future.

1

Let us know the van's reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need monthly van insurance?

Rather than committing to a full annual policy, monthly van cover gives you the flexibility to insure a van for just the time you need; whether that's for one hour, all the way up to 28 days.

It is a legal requirement that you ensure you have the appropriate insurance to drive on public roads in the UK. Monthly van insurance is ideal for those moments you only need to be insured to drive a van for a short time.

Rather than committing to an annual policy, monthly cover gives you the flexibility to insure a van for just the time you need.

If you don't need cover for the whole 28 days, we can still help! You can get van insurance hourly, daily or weekly online.

One of the biggest advantages to monthly van insurance is that it could save time and money. Instead of being added to someone else's annual policy, which can be expensive and affect their no claims discount, you get your own comprehensive cover. This keeps things simpler and ensures you're protected without the added hassle or cost.

So, if you're borrowing a van, lending one out, or just need occasional access to a van for personal reasons, monthly can be a smart, cost-effective solution.

You may need to add a driver for your van for van for a specific job for a month. Perhaps you need to borrow a van for a larger load - like moving or renovating your house and needing to pick up furniture and supplies. Monthly van insurance is perfect for business usage and carrying good that are related to your business. It's not suitable for carriage or other people's good, such as delivery or courier work.

Covertime's monthly van insurance is only suitable for drivers with a maximum of three penalty points with no previous claims in the last three years.

It gives you instant cover, total peace of mind, and complete flexibility... exactly when you need it.

Who is monthly van cover suitable for?

Carriage of own goods

Ages 22-69

Full UK licence holders

Max value £40,000

*Other terms and conditions apply.

How much does monthly van insurance cost?

The premium you’ll pay for your van insurance by the month will depend on several factors, including your age, driving experience, location, the time and date you need cover, the van you’ll be driving, and how long you need to be insured for.

If you only need to drive a van for a short period, a van insurance policy for a month can be an affordable and flexible option. However, keep in mind that the longer the duration of your cover, the higher the cost is likely to be.

You can take out multiple month-long van insurance policies throughout the year, especially if your driving needs are occasional or vary. But if you find yourself regularly using the same van, switching to an annual van insurance policy could work out more cost effective in the long run.

How can you get the cheapest monthly van insurance?

In order to get the cheapest monthly van insurance for you: only pay for the time you actually need to drive.

One of the biggest advantages of monthly van insurance is its flexibility. You can start your cover at the exact moment you need to drive and set it to end as soon as you're done. This way, you're not paying for unused time, keeping your costs as low as possible.

By insuring yourself on a van only for the specific period you need it; whether it’s for a quick delivery, a weekend move, or a short work project, you avoid the higher costs of unnecessary, longer-term policies.

You can choose cover from as little as one hour, up to 28 days. If you need more time later, simply take out another monthly van insurance policy, it’s quick, easy, and designed to work around your schedule.

Benefits of monthly van cover

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive the van to keep costs to a minimum.

Great for short term tasks

Need to move house or pick up some large large furniture or item? Monthly van insurance is perfect

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our monthly van insurance protects you, your passengers, your van as well as other people, property and vehicles.

Pay securely and easily

Monthly van insurance FAQs

You cannot legally drive a new van home without insurance. If you have an accident you won't be insured, even if it is new and you haven't sorted a new policy yet. Monthly van insurance is very easy to set up from anywhere, so you want to avoid ever driving without the appropriate insurance required by law.

To get van insurance for a month from us at Covertime, you'll need to have a full UK driving licence for at least 12 months. Learn more on our short term van insurance page here.

Yes you can take out multiple monthly van policies in a year, but there will come a point that if you're always insuring the same van, that an annual policy would be more cost-effective.

Our policies are currently unable to be extended and they do not renew. If you find yourself needing more time on the road, you can get a quote online anytime for the remaining duration you need - keeping things flexible. You can select a new durations, one hour, 24 hours, a week, all the way up to 28 days.

You’re only insured for the carriage of your own goods. This means it's suitable for personal use or transporting your own tools and equipment. It does not cover any form of hire or reward, including courier work, delivery driving, or using the van as part of a delivery service. If you're earning money from transporting goods, you'll need specialist commercial or courier insurance instead.

You can't take out monthly van insurance on a hired van. Short term monthly cover allows you to borrow a van and insure it, rather than insure a hired van.

The van must be physically located in the UK at both the start and end of the policy. Monthly van insurance is not valid for importing or exporting vehicles or for driving outside of the UK, EU, or EEA.

You are entitled to cancel your policy at any time.

You can cancel your policy by getting in touch with our team, either via our Live Chat or you can email us at [email protected].

It's important to bear in mind though that, unlike annual insurance, short period insurance policies of less than one months’ duration are not subject to the 14-day cooling off period. This is in line with the rules set by the Financial Conduct Authority (FCA).

Our refund policy is dependent on whether the cover has started.

Policies not yet started - if you let us know before the policy starts and ask us to cancel your policy, you may be entitled to receive a full refund. Please contact us as soon as possible and our team can look into this for you.

Policies where the cover has started - if you contact us after the policy has started and the cover is in force, whilst we can cancel the policy for you there will be no refund due to you. This is highlighted to you before you purchase the policy.

Our month by month van insurance policies do not currently include breakdown cover.

You must be between 23 - 69 years to take out van insurance for a month with Covertime.

Did you know?

Monthly van insurance is a clever way to protect your existing no claims bonus, as well as the person's who lent you the van.