24 Hour Van Insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Comprehensive van cover

Docs available immediately after purchase

Quick and flexible

Cover from one hour to 28 days

Protect existing No Claims Discount

Do everything online

Insure only for the time you need

Get on the road in minutes

What is 24 hour van insurance?

24 hour van insurance is a flexible way to get short term cover without signing up to a long annual policy.

It’s a great option if you need to borrow a van for a one-off job, help someone move, make a delivery or deal with an emergency. You only pay for the time you need, whether that's a full day or just a few hours, with no long-term tie-in.

You can get insured instantly or choose a start time up to 30 days in advance, and you'll be covered to drive anywhere in the UK.

Our 24 hour van insurance includes cover for the van you're driving, along with damage or injury caused to other people, vehicles or property.

If you need a van for a day, it’s a fast and simple way to get on the road legally and with peace of mind.

Transporting large furniture or items

Moving house or helping someone else relocate

Business use inc carriage of goods for that business

Emergency use if your van is off the road

Driving a new van home before you arrange an annual policy

Test driving a new van before you buy it

Driving a friend's or family member's van

Our 24 hour van policies are Comprehensive

What is covered?

Damage to the van you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the van unlocked

Wear and tear or windscreen

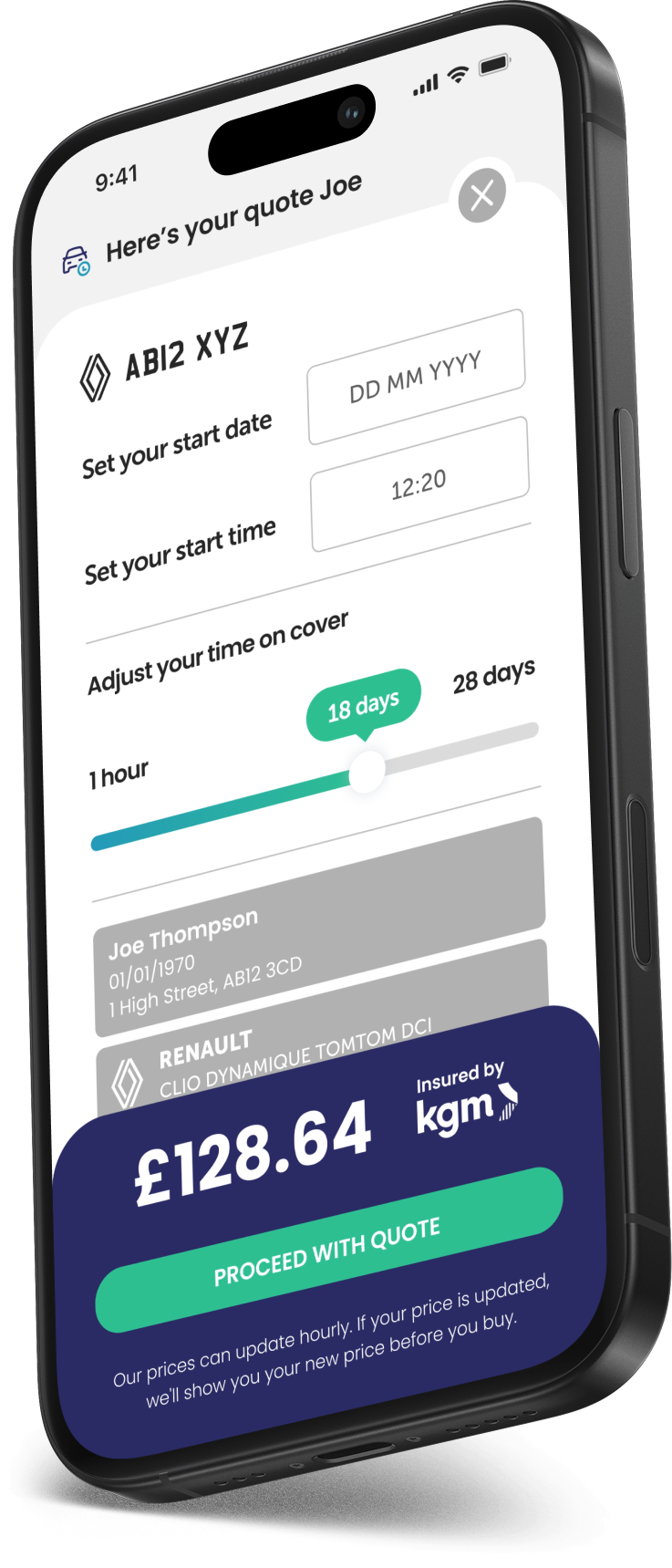

How to get 24 hour van insurance

Getting 24 hour van insurance is quick and straightforward.

You can get a quote in under a minute with our simple process. Whether you're borrowing a van for a move, running a job or collecting something bulky, 24 hour van insurance gives you the cover you need for just the time you need it.

1

Just let us know the van's reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need 24 hour van insurance?

If you only need to drive a van for a short time, 24 hour van insurance can be the right choice.

It’s ideal for one-off jobs like moving house, helping someone relocate, collecting furniture or test driving a van. Instead of paying for a full annual policy, you can get flexible cover that lasts just as long as you need it, whether that's an hour, a day or a bit longer.

You might also find 24 hour van insurance useful if your usual van is off the road and you're using a temporary replacement, or if you need a larger vehicle for a trip, event or festival.

One of the main benefits of 24 hour van insurance is that it can save you both time and money.

Rather than being added to someone else's annual policy, which can be costly and affect their no claims discount, you get your own cover. It's a simpler way to stay protected without the extra hassle or expense.

If you're borrowing a van, lending one out or only need access now and then, 24 hour van insurance is a smart and affordable way to get covered without committing to a full policy.

You might need to insure someone to drive your van for a day’s work, or perhaps you’re borrowing a van to move furniture or transport equipment. It’s also a good fit for business use when you're carrying goods that belong to you or your business. Just keep in mind it's not suitable for delivery or courier work involving other people’s items.

Covertime's temporary van insurance is only suitable for drivers with a maximum of three penalty points with no previous claims in the last three years.

With 24 hour van insurance, you get instant cover, clear terms and the freedom to insure a van only for the time you actually need it.

Who is 24 hour van cover suitable for?

Carriage of own goods

Ages 22-69

Full UK licence holders

Max value £40,000

*Other terms and conditions apply.

How much does 24 hour van insurance cost?

The cost of 24 hour van insurance is based on a number of factors, including your age, how long you’ve held your licence, your location, the van you’re driving, the start time and date of the policy, and how long you want to be insured for. Each of these plays a part in how your premium is calculated.

If you only need to use a van occasionally, short-term insurance can be a cost-effective way to stay covered without paying for more than you need. It's a good option if you're moving house, picking up bulky items, or need a van for personal business-related tasks on a short-term basis. However, the longer your policy lasts, the more you’re likely to pay, so it’s worth being clear on how much time you actually need.

You can take out several temporary van insurance policies over the year if your use is occasional or changes month to month. This gives you flexibility without locking you into a long-term commitment. But if you find yourself using a van regularly; for example, several days a week or on a routine basis, it’s worth comparing the cost of temporary cover against an annual policy, which may offer better value over time.

How can you get the cheapest 24 hour van insurance?

To get the cheapest 24 hour van insurance, only pay for the time you actually need to be on the road.

One of the key benefits of short-term cover is its flexibility. You can set your policy to start the moment you need it and end as soon as you’re done. This way, you’re not wasting money on unused time and can keep your costs down.

Whether you're using a van for a quick delivery, a weekend move or a short job, insuring yourself just for that period helps you avoid the higher cost of longer policies.

You can choose cover from as little as one hour up to 28 days. And if you need more time later on, you can simply take out another policy, it’s fast, straightforward and fits around your plans.

Benefits of 24 hour van insurance

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive the van to keep costs to a minimum.

Great for short term tasks

Need to move house or pick up some large large furniture or item? Short term van insurance is perfect

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term van insurance protects you, your passengers, your van as well as other people, property and vehicles.

Pay securely and easily

24 hour van insurance FAQs

No you can't take out 24 hr van insurance on a hired van. Short term insurance allows you to borrow a van and insure it, rather than insure a hired van.

You cannot legally drive a new van home without insurance. If you have an accident you won't be insured, even if it is new and you haven't sorted a new policy yet. Van insurance for 24 hrs is very easy to set up from anywhere, so you want to avoid ever driving without the appropriate insurance required by law.

Yes you can take out multiple 24 hr van insurance policies in a year, but there will come a point that if you're always insuring the same van, that an annual policy would be more cost-effective.

It’s important to understand what 24 hour van insurance does not cover. You’re only insured for carrying your own goods, which means it is suitable for personal use or transporting your own tools and equipment. It does not cover any form of hire or reward, such as courier work, delivery driving, or using the van as part of a delivery service. If you are earning money from transporting goods you will need specialist commercial or courier insurance.

You are also not covered if you’re driving a hired or rental van. In that case a specific rental vehicle insurance policy is required.

The van must be physically located in the UK at the start and end of the policy. 24 hour van insurance is not valid for importing or exporting vehicles or for driving outside the UK, EU or EEA.

Yes you can use van insurance for 24 hours to get an MOT on your van, but it must be for a pre-booked MOT appointment.

Yes you can insure a van for just 24 hours. 24 hour insurance is completely flexible, not only does it allow you to drive the van of a family member or friend, it allows you to choose the exact amount of time you need to use the van for.

You can insure a van for as little as one hour to 28 days.

Did you know?

Did you know that using temporary van insurance won’t affect your no claims discount on your regular policy if you have to make a claim?