Daily car insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

Can Covertime provide daily car insurance?

At Covertime, we offer flexible daily car insurance that fits around your schedule, so you can drive with peace of mind, knowing you’re covered for exactly the time you need.

Daily car insurance lets you get insured for a full 24 hours, starting and ending whenever you choose. It’s perfect for drivers who need cover for the day, a weekend, or on a day-by-day basis.

Whether you need cover for a single day or a few days, our daily car insurance provides a fast, hassle-free way to stay protected without long-term commitments.

Moving house

A spontaneous getaway

Driving your new car home

Borrowing someone else's car

Bridging a gap in annual coverage

Our daily insurance policies are comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Sole damage to the windscreen

How to get daily car insurance

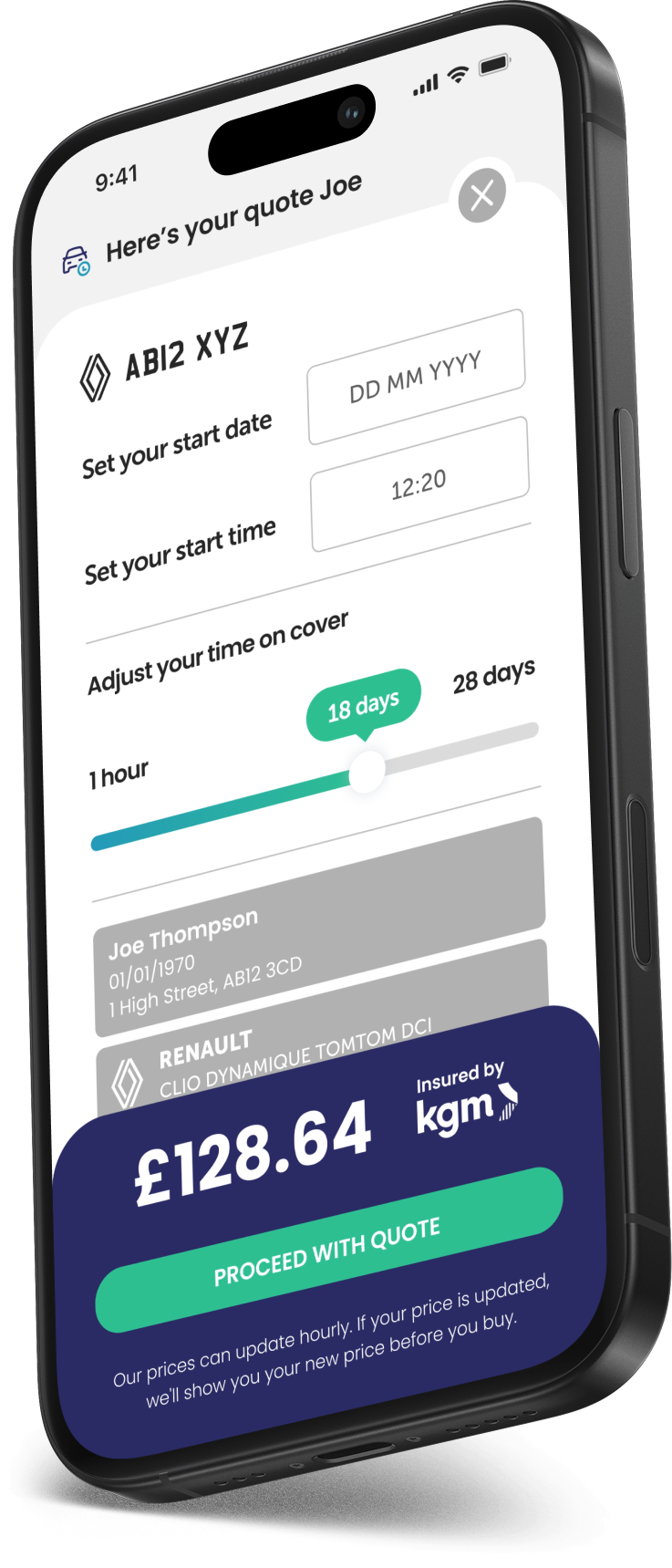

The good news is, getting daily car insurance online is simple and only takes a few minutes. You can get a price for your daily insurance in under one minute.

We don't waste our time or yours with a long set of never-ending questions. We only ask you the information we absolutely need to get you covered and let the technology do the rest behind the scenes.

Need cover for the day on the day? No problem, select that you’d like your cover to start right away and it usually only takes a few minutes to get you set up and on the way!

If you’re super organised and are setting up cover in advance, you can do this by selecting the exact date and time you’d like your cover to start up to 30 days in the future.

1

Just let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs daily car insurance?

There are plenty of reasons why you might be looking for car insurance for the day.

You could be feeling spontaneous and fancy a day trip to the coast, or maybe you need to borrow someone's car to run errands for the day. One of the times daily car insurance comes in particularly handy, is when you or someone you’re helping is moving house! You could need to insurance a car for more than a day, perhaps two or three days car insurance will do the job, it's all possible and if you need more, just take out another policy; you can even do it via our app!

Who is daily car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much is daily car insurance?

Daily car insurance is a smart way to keep costs down if you're only looking to insure a car for a very short amount of time, because you're only paying for what you need.

The cost of car insurance by the day will depend on a few factors:

about you | your car | when you need it to start | how many hours you're planning to be out on the road.

Our quote process is super quick and will only need a few details, these are then used to calculate your daily car insurance premium:

- How long you need it for: The length of time you need insurance will impact the price. Longer periods of cover will usually cost more.

- The car you're driving: The make, model, power and cost of the car you want to insure could affect the cost of your cover.

- You and your licence: Your driving experience will also play a factor in your hourly insurance premium.

How can you get the cheapest daily insurance?

To get the cheapest daily car insurance, make sure you only purchase cover for the exact amount of time you need.

Daily insurance allows you to insure yourself at the exact time you need to start driving and set it to end when you need it to.

Choose from as little as one hour all the way up to 28 days. When you get a quote, you can use the slider to change your cover duration to make sure you’re getting the best value for the time on cover you need.

What is daily car insurance?

Daily car insurance is a flexible, standalone policy that provides comprehensive cover for 24, 48 or 72 hours or more. Unlike an annual policy, which locks you in for a year, a daily policy allows you to pay only for the time you actually spend on the road. It is the ideal solution for drivers who need instant, short term protection without the admin fees or commitment of a standard insurance contract.

Common use cases for by the day insurance

Drivers turn to daily car insurance for one of three reasons:

Borrowing a car: Whether it is a trip to the tip, a weekend visit home, or helping a friend move house, getting your own daily policy can be faster than being added as a named driver.

Driving a new car home: If you have just bought a car from a dealership or private seller, a daily policy covers you from the moment you drive off the lot until you can set up a long-term plan.

Emergency cover: If your main vehicle is in the garage and you need to borrow a family member's car to get to work, you can get covered in under 60 seconds.

Why choose daily over annual changes?

The biggest benefit of daily car insurance is that it is a separate policy. This means:

No risk to NCD: If you have an accident, the car owner’s No Claims Discount remains completely untouched.

Total transparency: In line with the 2026 Consumer Duty standards, we ensure you only pay for the cover you use... no hidden admin fees.

Instant acceptance: Our daily cover is active almost immediately after you have paid if you have selected immediate cover.

Is daily cover legal for all drivers?

Yes, as long as you have the owner's permission and a valid UK licence. At Covertime, our daily car insurance details are uploaded to the Motor Insurance Database (MID) instantly, ensuring you are visible to police ANPR cameras immediately after purchase and your policy start time has begun.

Benefits of short term insurance by the day

Choose your time

You can now choose how long you need cover, whether it's for 1 day or 28 days - why pay for more?

Comprehensive cover

Our daily car insurance protects you, your passengers, your car as well as other people, vehicles and property.

Great for new car purchases

Sort out insurance for a new car on a short term basis, quickly and easily, from wherever you bought your new vehicle.

Quick, easy and affordable

Covertime is proudly faff-free! Get a quote quickly and keep costs to a minimum.

Pay securely and easily

Daily insurance FAQs

Yes you can take out a comprehensive car insurance policy with Covertime for just one day, two days, or even a long weekend. You get to decide how long you need cover and not commit to a minute more than necessary.

Provided that you have their permission, you can absolutely get daily car insurance to borrow someone else's car. In fact it's actually quite a quick, simple and often cost-effective way to get insured, depending on how long you need to use the car, whether that's for one day, or the whole weekend. It means they can avoid putting you as a named driver on their policy and it won't affect their no claims bonus.

When you take out daily car insurance with Covertime you'll always know the date, time and how long you're covered for.

As soon as you've purchased your daily insurance policy, we'll send you your policy confirmation email which contains a link to access and download all of your policy documents, instantly to your inbox. This email and those documents will tell you absolutely everything you need to know about your daily car insurance cover.

We’ll also send you a reminder when your cover is about to expire, so you’ll never be caught out without your insurance in place.

If you’re borrowing someone else’s car, it is a legal requirement to make sure you are correctly insured.

Even if their car is insured already, that doesn’t mean that you are personally insured to drive it, and the same principle applies if you already have a car insurance policy in place – you shouldn’t assume you’re covered to drive someone else’s car.

Make sure you know what's covered on your annual policy by reviewing your policy documents. Whilst some comprehensive annual policies can provide DOC (Drive Other Cars) cover, this is not always the norm and does often come with a few caveats.

Temporary or short-term car insurance can be a simple and often cost-effective way to get insured to drive someone else’s car for a day.

If you're looking to borrow the car for a short period of time or just a one-off, temporary car insurance is fully comprehensive, and it won’t affect your no claims bonus which is certainly a bonus in itself!

At the moment our policies cannot be extended and do not renew. Don't worry though, we won't stand between you and the open road - you can purchase a new policy for another day, or just a few more hours by getting a fresh quote anytime, for however long you need it.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.