Three Day Car Insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is three day car insurance?

Three day car insurance does exactly what it says on the tin - gives you a comprehensive car insurance policy for just three days.

Sometimes two days isn't enough and a week can simply be too much, but three days could be just right - especially for those lovely long weekends and occasional spontaneous getaways. Car insurance for three days is also ideal for maybe those slightly less exciting and glamorous occasions, such as moving house, borrowing a car to run errands or bridging a gap between annual insurance policies.

What we love about temporary car insurance is how flexible it can be. You get to decide how long you'd like to be covered and not a minute, hour or day more - so if you need cover for three days, we can help with that.

Being able to get insurance for three days could be a game-changer for a number of reasons:

Bank holiday road-trips

A three day work trip

Moving house - sometimes a 2-day weekend just isn't enough

Sharing the drive on a three day trip

Bridging a gap between annual policies

Our policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

How to get insurance for three days

Getting insurance for 3 days really couldn't be easier!

At Covertime, we are proudly faff-free, which means we like to keep things simple to get you on the road as quickly as possible.

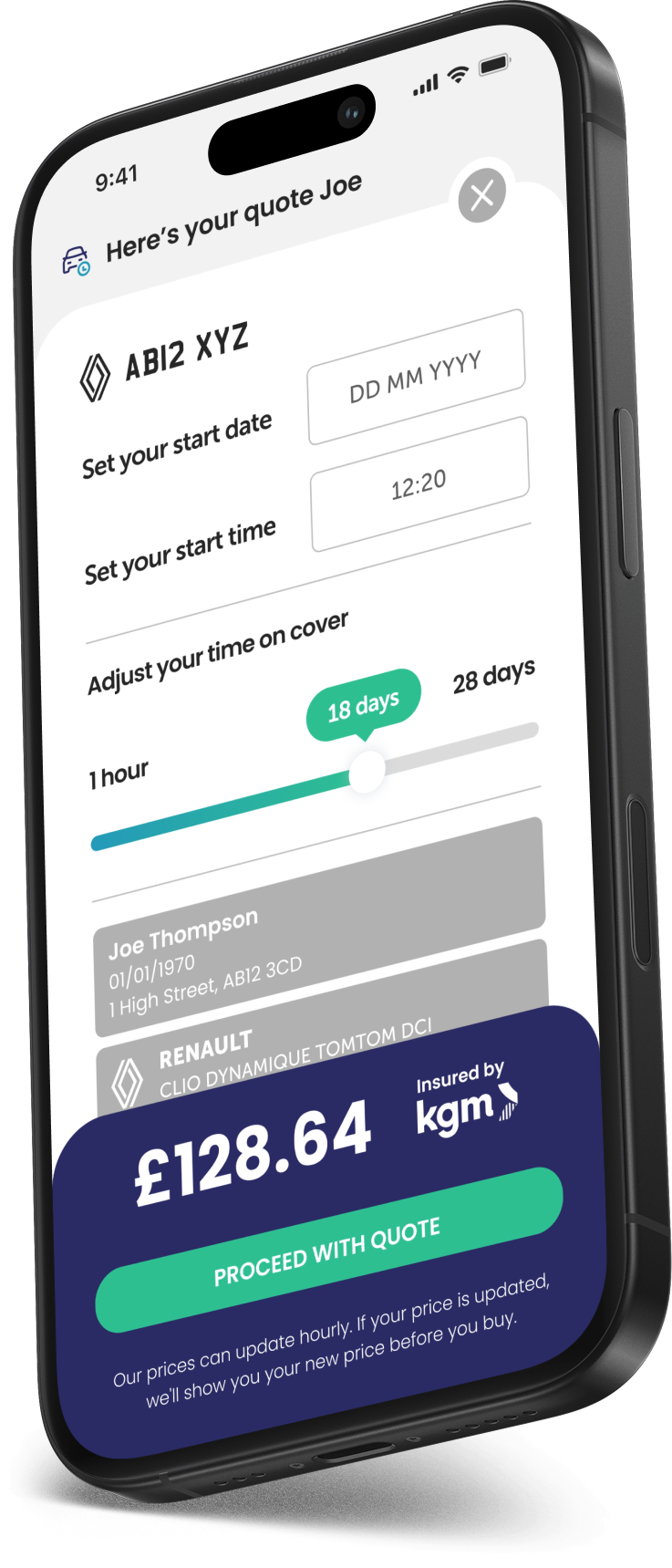

We only ask the basics - when you get a quote online we need to know some things about you, the car registration, how long you need your three day cover & when you'd like cover to start.

1

Let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs three day car insurance?

There are plenty of reasons why you might be looking for car insurance for the 3 days.

You could be feeling spontaneous and fancy a three day trip to the coast, or maybe you need to borrow someone's car to run errands for a few days. One of the times three day car insurance comes in particularly handy, is when you or someone you’re helping is moving house and a weekend policy might not be enough time to get it all done.

Who is 3 day car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does 3 car insurance cost?

The premium you will pay for your 3 days car insurance will depend on things such as your age, experience, where you live, when you need cover, the car you'll drive and how long you need to drive it for.

If you only need to drive a car for three days, then a 3 day car insurance policy might be an affordable option for you. However, the longer you need to insure yourself on the car for, the more it will cost.

You can buy multiple 3 day car insurance policies throughout the year, but at some point an annual car insurance will become more cost effective, if you're always using the same car.

How can you get the cheapest three day car insurance?

The golden rule to get the 3 day temporary car insurance cheap is: Only buy the cover for the time you need.

The beauty of three day car insurance is that you can insure yourself at the exact time you need to start driving and set it to end when you need it to.

By only insuring yourself on the car for the time you need to drive it, you can keep your 3 days car cover costs to a minimum.

Choose from as little as one hour all the way up to 28 days. If you need more time after one policy ends, then you can take out new temporary car policies.

Benefits of 3 day car insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Three days car cover FAQs

Yes you can use temporary insurance to bridge a gap between annual insurance policies, that's actually one of the most popular reason people might need cover for 3 days.

Yes, you absolutely can insure yourself on someone else’s car for three days with temporary car insurance, that is one of the main reasons people get it. Just make sure you have the owner’s permission, obviously.

Yes you can take out 3 day car insurance policies in a year, but there will come a tipping point that it would make more sense cost-wise to take out an annual policy.

You have comprehensive cover as standard to drive in Great Britain and Northern Ireland, the Isle of Man, the islands of Guernsey, Jersey and Alderney.

All journeys must start and end in the UK however, if you do decide to travel a little further and you're driving inside the EU, you'll be covered for the minimum legal level required by law in that country. In the EU the minimum legal level is third party only (TPO), meaning damage to the car you are driving is not covered.

We are not able to cover countries outside of the EU.

Of course! Why should you have to wait around? When you're taking out your policy with Covertime, select that you'd like your policy to start right away and we'll make it happen.

At the moment our policies cannot be extended and do not renew. Don't worry though, we won't stand between you and the open road - you can purchase a new policy for another 3 days, just a few more hours or days cover by getting a fresh quote anytime, for however long you need it.

With annual insurance you pay for the full 365 days of cover on your car insurance, whereas with 3 days car insurance you only pay for the time you need (three days!). That is why it's worth checking to see if a short term policy is cheaper for you.

There are also a few ways that you can try and get the cheapest temporary car insurance.

- Don't purchase adds ons you don't need; for example, you may have breakdown cover with your bank account

- Have a choice of cars to borrow? It might be worth getting quotes to see which car produces the cheapest quote for you

- Build your experience; the longer you've held your licence claim-free, the better

The handy thing about a 3 day car insurance policy is that in the unfortunate event of a claim arising while under the temporary policy, it won't affect your existing No Claims Bonus.

Did you know?

Three day car insurance policies give you comprehensive cover that doesn't affect your no claims bonus.