Insurance Options For a Borrowed Car

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

Borrowing someone else's car?

Let's talk options.

First things first, when you’re borrowing a friend or family member’s car, it’s important to make sure that you have their permission – it might seem obvious, but it’s worth mentioning to avoid any uncomfortable misunderstandings and subsequent awkward family dinners.

Once you have their permission, it’s time to make sure you have the correct insurance in place before you set off.

Even if their car is insured already, that doesn’t mean that you are personally insured to drive it, and the same principle applies if you already have a car insurance policy in place – you shouldn’t assume you’re covered to drive someone else’s car.

Some comprehensive annual policies can provide DOC (Drive Other Cars) cover, but this is not always the norm for most policies and does often come with a few caveats.. but we'll go into that a bit further down.

There are plenty of reasons you might find yourself needing to borrow someone else's car..

Sharing the drive on a long trip

Helping someone move house

Helping out a friend of family member

Borrowing a car in an unexpected emergency

Staying with friends or family and using their car to get around

Covertime policies are Comprehensive

What is covered?

Damage to the car you've borrowed

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Sole damage to the windscreen

Do you need insurance to borrow a car?

There is a common misconception that all comprehensive insurance policies allow you to drive any other car.

If you already have an annual comprehensive car insurance policy in your name, you might be covered to drive someone else's car under the 'Driving Other Cars' (DOC) rules.

However, this is not standard and not everyone has this cover in their Comprehensive policy. If you do have DOC, it is only meant for emergencies and not regular use.

Drivers under the age of 25 will not usually have DOC cover, so make sure you check with your insurer.

It's important to be aware that when you drive someone else's car under Driving Other Cars, the cover changes from Comprehensive to only covering damage to the other car or other people if you have an accident - referred to as Third Party Only (TPO).

If you don't have your own insurance then you can be added as a second driver or 'named driver' to another person's policy.

However, if a second driver has to make a claim on this policy then it would impact the main driver's No Claims Discount (also known as No Claims Bonus). It could potentially increase their insurance premium at renewal.

If you only need to use a car for a short period of time, even for just 24 hours, or a few hours, then choosing a Covertime temporary car insurance policy could be more convenient. It also avoids risking the car owner's No Claims Discount; which will give them peace of mind when you borrow their car.

How to get temporary car insurance

Getting temporary car insurance to borrow a car really couldn't be easier!

Forget the days of filling out pages of relentless questions for your annual car insurance quote. With our simple quote process, you can get a quote in a couple of minutes in just a few simple steps...

1

Let us know the vehicle reg and a few details about yourself

2

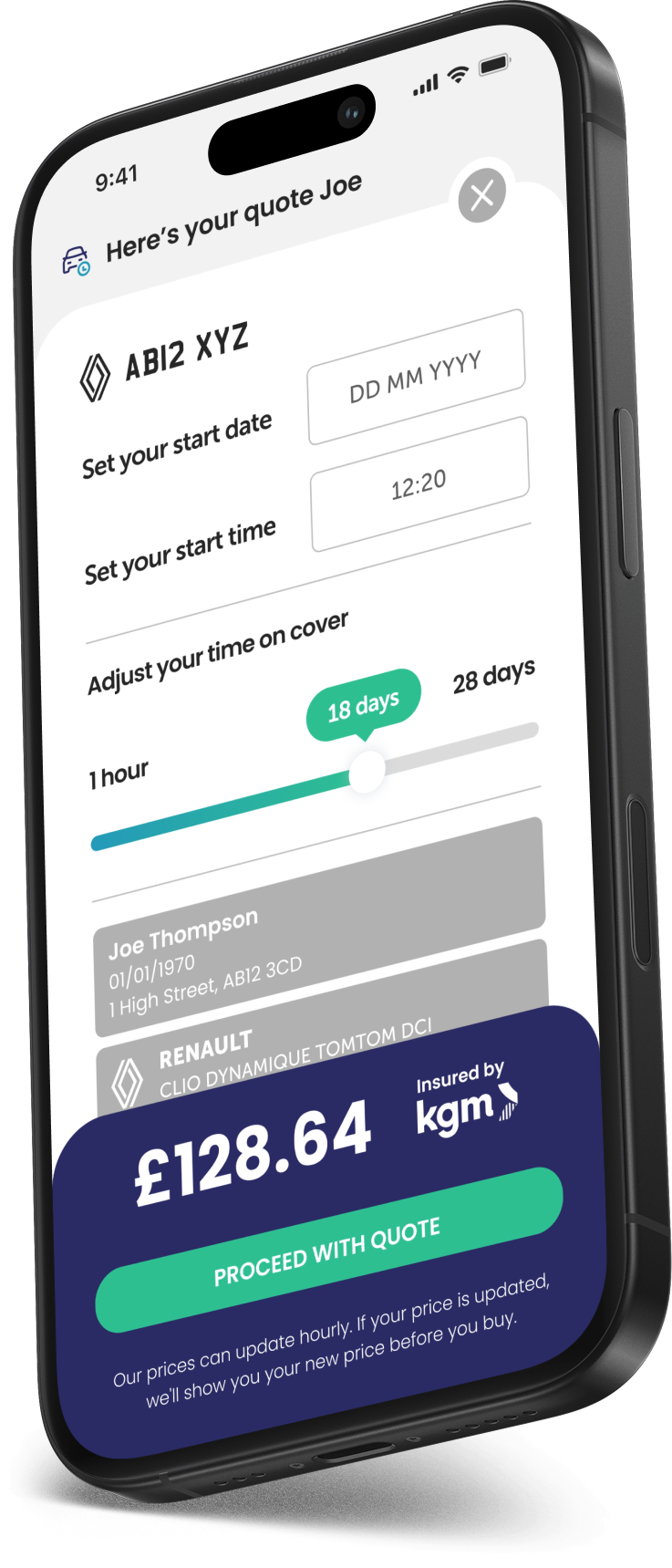

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who is temporary car cover suitable for?

Borrowing a car

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does temporary car insurance cost?

The premium you will pay for your short term car insurance will depend on things such as your age, experience, where you live, when you need cover, the car you'll drive and how long you need to drive it for.

If you only need to drive some else's car for a small amount of time, then a temporary car insurance policy might be an affordable option for you. However, the longer you need to insure yourself on the car for, the more it will cost.

You can buy multiple temporary car insurance policies throughout the year, but at some point an annual car insurance will become more cost effective, if you're always using the same car.

How can you get the cheapest temporary insurance to borrow a car?

The golden rule to get the cheapest temporary car insurance when you're borrowing a car is: Only buy the cover for the time you need.

If you're looking to borrow the car for a short period of time or just a one-off, temporary car insurance is comprehensive, and it won’t affect your no claims bonus which is certainly a bonus in itself!

By only insuring yourself on the car for the time you need to drive it, you can keep your short term car cover costs to a minimum.

Choose from as little as one hour all the way up to 28 days. If you need more time after one policy ends, then you can take out new temporary car policies.

Benefits of temporary car insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Borrow a car insurance FAQs

One of the best things about temporary car insurance is its flexibility. If you’re needing to borrow a car for a period between 1 hour and 28 days, this may be the solution for you. You can get insured on someone else's car hourly, daily, weekly or up to 28 days.

If you're likely to be borrowing someone else's car very regularly or for longer periods of time, it might be worth looking to get your name added to their annual policy as an option.

Whether you're borrowing a car for a few hours or a few weeks, having the right insurance in place ensures you are legally compliant and financially protected. It takes a couple of minutes to arrange the appropriate coverage which can save you from a lot of stress and potential legal issues down the road.

Yes, you absolutely can insure yourself on someone else’s car with temporary car insurance, that is one of the main reasons people get it. Just make sure you have the owner’s permission.

Yes you can take out multiple temporary policies in a year, but there will come a tipping point that it would make more sense cost-wise to take out an annual policy.

For brand new drivers ie they passed their test two days ago, unfortunately they cannot get temporary insurance. But new-ish drivers can.

They need to have held a full UK driving licence for at least six months. So, if they've just passed their test, congratulations, but they'll need to wait for six months before they can get a temporary car insurance policy with Covertime.

Some comprehensive car insurance policies include something called DOC cover, which stands for Driving Other Cars. This allows the policyholder to drive someone else’s car, provided they have the owner's permission. Sounds great right? However, there are some things to keep in mind...

Not everyone is eligible for DOC cover, and it is typically available to those over a certain age, usually 25 years and above. It might also be limited to specific policyholders with a proven driving record.

Look out for the type of cover that's included, as DOC typically provides third-party only insurance. This means that if you are involved in an accident while driving someone else’s car, the insurance would only cover damage to third parties, not the car you are driving or yourself. Some policies can also include restrictions on the type of cars you can drive, such on high-value or high-performance vehicles.

Temporary car insurance is perfect for short term needs, but if you require coverage for a longer duration, an annual policy may be more cost effective.

It doesn't cover you for driving a rental or hired car; you'll need a specific hire car insurance policy for that.

Short term cover also is not suitable if you're planning on using it to be a cabbie - you'll need proper taxi insurance to do that. It's also not to be used for deliveries or courier work.

Temporary car insurance is also not suitable for releasing a vehicle from a Police or Local Authority impound, learning to drive, driving outside of the EU/EEA and for importing / exporting cars; the vehicle must be in the UK at the start and end of the policy.

With annual insurance you pay for the full 365 days of cover on your car insurance, whereas with temporary car insurance you only pay for the time you need. That is why it's worth checking to see if a short term policy is cheaper for you.

There are also a few ways that you can try and get the cheapest temporary car insurance.

- Don't purchase adds ons you don't need; for example, you may have breakdown cover with your bank account

- Have a choice of cars to borrow? It might be worth getting quotes to see which car produces the cheapest quote for you

- Build your experience; the longer you've held your licence claim-free, the better

No need to worry about being caught out without cover - we'll send you an email letting you know when your cover is about to expire.

We can't extend our policies, but if you need more time on the road you can get a new quote online anytime.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.