Emergency Car Insurance Coverage

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is emergency car insurance?

Emergency car insurance is simply another term for temporary car insurance. It is easy, quick, flexible and affordable car insurance which is why it’s perfect for emergencies.

This could be due to an unexpected situation, such as your car breaking down, borrowing a friend's car in a hurry, or needing to drive a newly purchased vehicle home.

Emergency car insurance can be quoted for and purchased extremely fast, often within minutes, meaning you can get on the road in no time following payment and confirmation of your policy.

Our emergency policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

How to get emergency car insurance

With Covertime’s super quick quote process and the ability to get on the road shortly afterwards, emergency car insurance has never been so efficient.

You can get emergency car insurance in just a few minutes by following a few simple steps.

1

Just let us know the vehicle reg and a few details about yourself

2

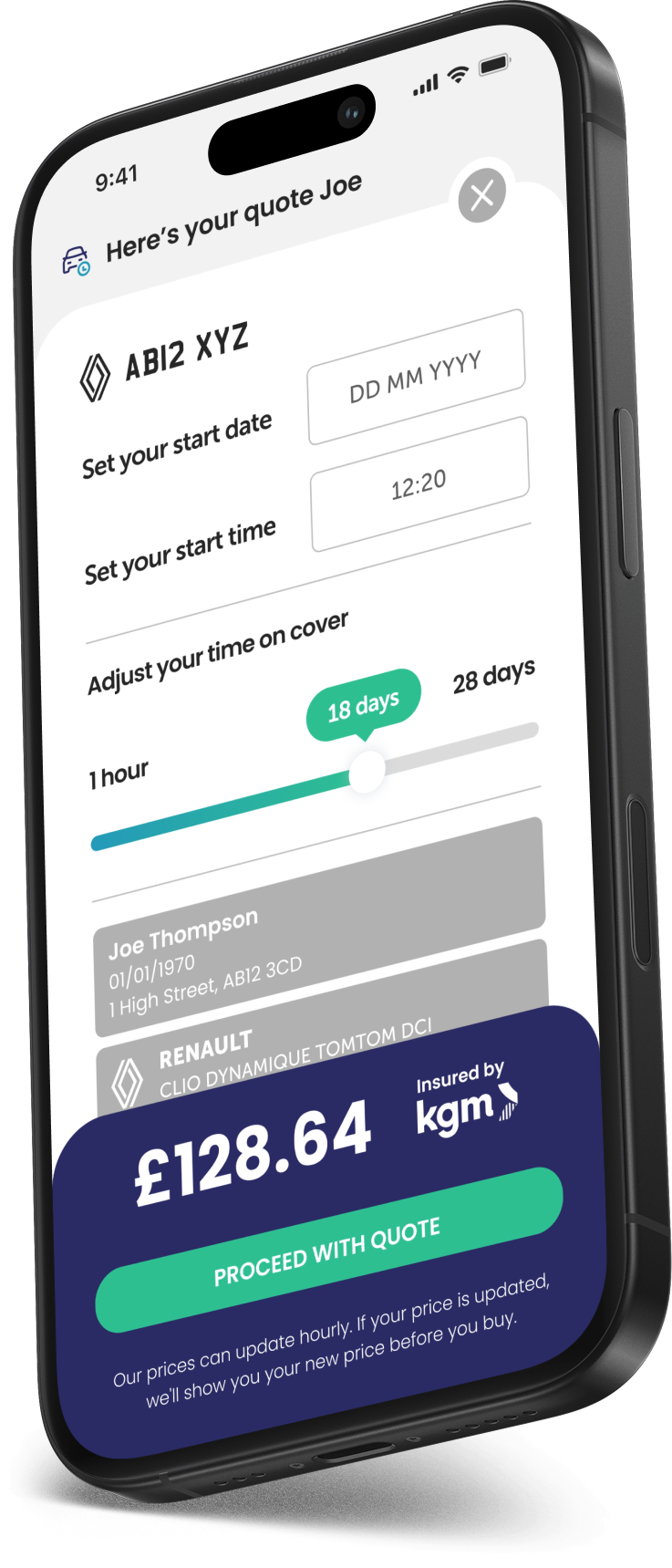

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs emergency car insurance?

There are many reasons why drivers may need to insure a car in an emergency. You may just need insurance for a very short amount of time such as an hour or 24 hours. You may need emergency car insurance for some of the following reasons:

- Driver is ill or unable to drive

- Your car won’t start so you borrow someone else’s car

- Need to make a sudden journey

- Unexpected journey

- Get to a hospital or appointment

- Reach someone in need

Emergencies can take many different shapes and sizes, so emergency car insurance is ideal for anyone who needs temporary cover for an unexpected situation, fast.

Who is emergency car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does emergency car insurance cost?

The cost of emergency car insurance varies depending on several factors, including the duration of the coverage, the type of vehicle, when you need cover to start and the driver's experience and driving history.

Emergency car insurance can be purchased for the exact amount of time that you need to use the car for. This means that you don’t have to pay more than you need to for the cover.

If you only need to make a short trip then you can insure a car in an emergency for just one hour – therefore only paying for the minimum amount of time possible and saving you money.

You could also need emergency short term cover for longer than an hour. Perhaps someone you know can’t drive for a few days and still needs to get around? You can select any length of time from one hour to 28 days for your emergency car insurance with Covertime.

How to get cheap emergency car insurance?

You can keep your emergency car insurance premium as cheap as you can by insuring the car for the exact amount of time you need on cover.

If your journey only takes an hour to go there and back, then you can just insure the car you need to drive for that amount of time. This way there is no wastage and you only pay for the time that you're driving the car.

If you need more time after one policy ends, then you can take out a new short term car insurance policy.

Benefits of emergency car insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our emergency car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Fast and efficient

In a hurry? Get on the road in minutes after confirmation and payment!

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Emergency car insurance FAQs

It is a legal requirement to have insurance on any car that you drive, so you cannot under any circumstances drive a car that you do not have insurance for.

Insurance on a car can come in many forms from your own annual car insurance policy, the ability to add drivers to an annual policy, 'driving other cars' cover on a comprehensive policy and finally temporary cover on a short term basis.

These are your options for insuring your car in an emergency so you must have one in place; or face the potential of a fine or points on your licence, should you be pulled over by the police for lack of insurance.

If you have your own comprehensive car insurance policy, you might be able to drive someone else’s car in an emergency. This type of cover is known as ‘Driving Other Cars’ it can be referred to as ‘DOC’ for short.

It means that you can drive other cars on your annual car insurance policy for emergencies only.

IMPORTANT NOTE: DOC cover only covers you to drive other cars on a Third Party Only basis. This means that you and the car you are driving would not be covered in an accident, as you would be with your comprehensive policy. Instead, DOC for emergencies will only cover other people and other vehicles should you have an accident.

Yes you can take out numerous emergency car insurance policies. If one emergency policy ends and you didn't have enough time, you can take out another policy.

You cannot drive a car on someone else’s insurance policy unless you are specifically added as a named driver to their policy. There are occasionally polices that allow other drivers to use a car that they are not named on but these are usually in place for fleets or premium cars and policies.

If you are ever in doubt about whose car you can drive and who can drive your car, it is best to ask your insurance provider directly or refer to your policy wording.

Emergency car insurance is there for you when you need it. Emergency quotes can be done in minutes and you can get on the road shortly after payment.

You can tailor your emergency car insurance to last for as long as you need it to, from as little as one hour up to 28 days.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.