Temporary Car Insurance

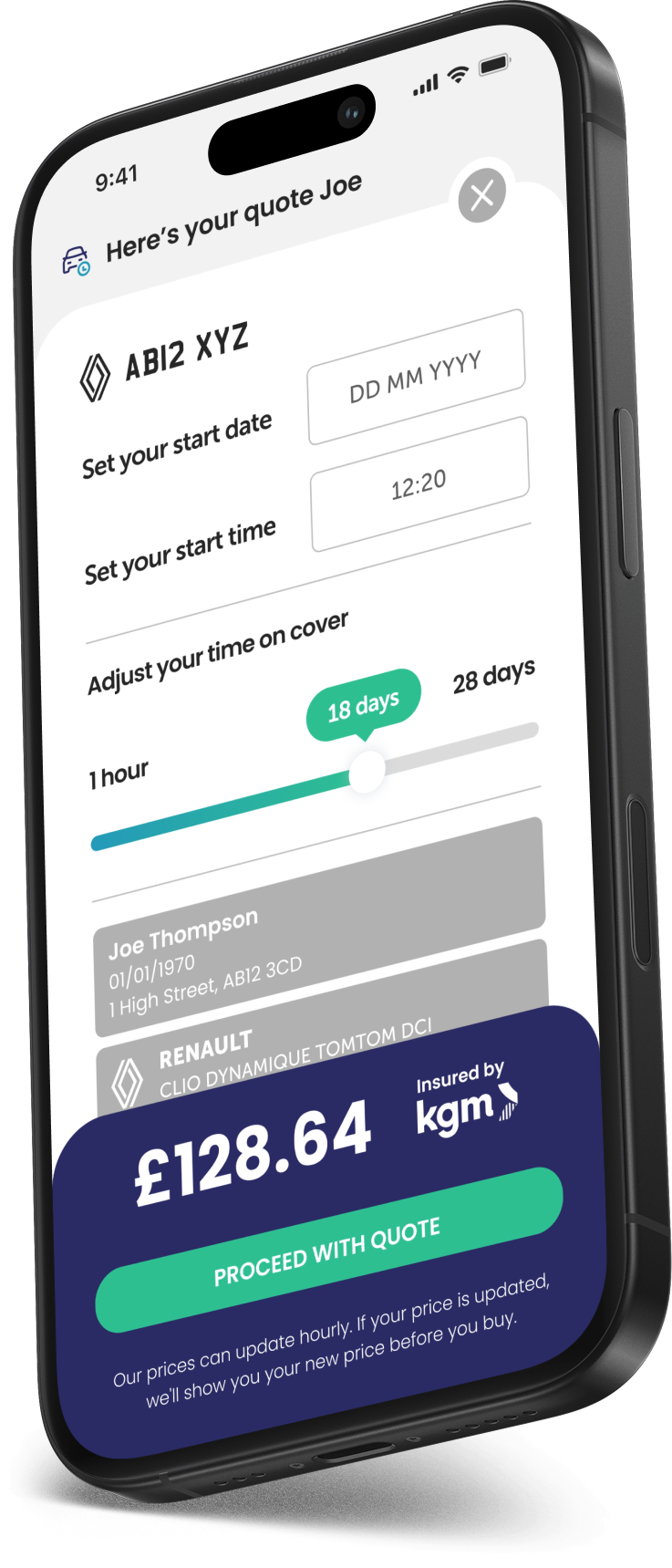

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is temporary car insurance?

Temporary insurance for cars gives you quick and easy short term coverage for driving a car.

Whether it's your own or a car that belongs to a friend or family member, you can get insured quickly for the exact amount of time you need.

It can start immediately after you've paid or a chosen point within 30 days.

Our temporary cover for a car is comprehensive so it will cover you, the car you're driving, as well as other people and other vehicles.

Short term car insurance can be seriously handy for lots of different situations such as:

Driving a friend's or family member's car to help them out or for your own use

Driving a new car home before you sort an annual policy

Test driving a new car before you buy it

Driving a second car that you don't use very often

Sharing the drive on a long trip

Using a car in an emergency

Our policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

When would you use temporary car insurance?

Many drivers assume comprehensive insurance lets them drive any car, but this isn’t usually the case. Temporary car insurance is designed for short, specific situations where existing cover doesn’t apply or isn’t practical.

Borrowing a friend or family member’s car

Driving Other Cars (DOC) cover isn’t standard and is often restricted or unavailable, especially for drivers under 25. Temporary insurance provides fully comprehensive cover without risking the car owner’s No Claims Discount.

Test driving or buying a car

Temporary insurance allows you to test drive a vehicle or drive a newly

purchased car home legally and comprehensively before arranging an annual

policy.

Driving a second car occasionally

If you only use another car from time to time, temporary cover can be more practical than maintaining a second annual policy.

Sharing driving on a long trip

Ideal when sharing driving responsibilities on longer journeys, including work related travel.

Short-term or emergency use

Temporary insurance can be arranged quickly, making it suitable for unexpected situations where you need to be insured straight away.

If you don’t need to use a car for a short period, temporary insurance can be a convenient and cost-effective option, while avoiding changes to existing policies or No Claims Discounts.

Temporary Insurance – The Data

Who’s using Temporary Insurance?

71% of drivers have heard of temporary insurance

15% of drivers have used it in the last two years - that's 5.4 million drivers!

Most people hear about it from friends (word of mouth), online searches, or social media

Why are UK drivers choosing temporary insurance?

People use temporary insurance because it’s flexible and cost effective. The most common reasons people get it are:

Buying a new car – get covered while sorting out an annual policy

Borrowing a car – need to drive a friend’s car for a weekend, no problem!

Driving less – working from home? Not driving as much? Pay only for what you need

Saving money – avoid paying for an annual policy if you don’t need it

Eco-conscious drivers – some people want to drive less for environmental reasons

Do drivers like temporary insurance?

In short, yes, but here’s the stats:

✔ 83% of users say they’re happy with their temporary insurance experience

✔ 68% think the pricing is fair

✔ 79% would recommend it to a friend

Temporary insurance is set to grow as more people want flexible, affordable, and hassle-free coverage.

*Stats based on LexisNexis White paper, March 2023.

How to get temporary car insurance UK

Getting temporary insurance cover on your car really couldn't be easier!

Forget the days of filling out pages of relentless questions for your annual car insurance quote. With our simple quote process, you can get a quote in a couple of minutes in just a few simple steps...

1

Just let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need temporary car insurance?

Many drivers assume comprehensive insurance lets them drive any car, but this

is often not the case. Whether you need temporary car insurance depends on

your existing cover and how long you need to use the vehicle.

If you already have car insurance

Some comprehensive policies include Driving Other Cars (DOC) cover, but it is not guaranteed and is becoming less common. Where DOC does apply, cover is usually Third Party Only, meaning damage to the car you’re driving is not covered. Drivers under 25 are often excluded entirely, so it’s important to check your policy carefully.

If you don't have car insurance

You may be added as a named driver to someone else’s policy, but any claim you make could affect the main driver’s No Claims Discount and increase their premium at renewal.

Why temporary cover can be safer

You may be added as a named driver to someone else’s policy, but any claim you make could affect the main driver’s No Claims Discount and increase their premium at renewal.

Who is temporary car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does temporary car insurance cost?

The premium you will pay for your short term car insurance will depend on things such as your age, experience, where you live, when you need cover, the car you'll drive and how long you need to drive it for.

If you only need to drive a car for a small amount of time, then a temporary car insurance policy might be an affordable option for you.

However, the longer you need to insure yourself on the car for, the more it will cost.

You can buy multiple temporary insurance policies throughout the year, but at some point an annual car insurance will become more cost effective, if you're always using the same car.

How can you get the cheapest temporary car insurance in the UK?

The golden rule to getting cheap temporary car insurance is: Only buy the cover for the time you need.

The beauty of temporary cover is that you can insure yourself at the exact time you need to start driving and set it to end when you need it to.

By only insuring yourself on the car for the time you need to drive it, you can keep your short term car cover costs to a minimum.

Choose from as little as one hour all the way up to 28 days. If you need more time after one policy ends, then you can take out new temporary car policies.

Temporary car insurance specialists

We're specialists in short term car insurance...

We may be relatively new in the temporary insurance market but we're absolute specialists in providing short term car insurance in the UK. All our team have been working in the insurance industry for decades, with most of us working for temporary insurance providers for 20 years!

We decided to start a new and fresh temporary insurance provider and do everything in the best way possible.

Our previous temporary insurance experience has shown us how to do things the right way and of course, somethings we learnt are the wrong way, so that's what Covertime is here to sort out!

When it comes to our temporary insurance with Covertime, you can choose exactly the right amount of time you want to insure the car for. You'll be able to set up short term cover on a car you own or don't own, in just a matter of minutes.

You can get a quote in less that 60 seconds, we took out all of the unnecessary questions and made it almost effortless to get a short term car insurance quote with us!

We don't have a huge call centre with long wait times to get through; instead we opted to make it so easy to deal with us, that you can fully get your temporary insurance cover online in no time!

If you are stuck and have some temporary car insurance questions, then we are available on live chat. If you decide that you really must speak to us, then we will happily give you a call if you request it.

We're proud to be offering UK drivers one of the quickest and easiest methods of insuring a car; we put our customers interests at the heart of everything we do. You've just found your favourite temporary insurance company.

Benefits of temporary car cover

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

What types of cars can insure in the short term?

We can cover a huge variety of cars with our temporary insurance ranging from the value of £1,500 all the way up to £65,000.

Here are the types of cars we can insure on a temporary basis in the UK. The best part is, you just enter the reg and we'll do the rest!

No need to start finding the exact make, model, vehicle value etc. we've got clever technology in place that will look that information up accurately in the blink of an eye...

Hatchback

Small to mid-size cars with a rear door that opens upwards, offering practicality and good fuel economy.

Examples: Ford Fiesta, Volkswagen Golf, Vauxhall Corsa, Renault Clio, Peugeot 208, Toyota Yaris, Hyundai i20, SEAT Ibiza, Mini Cooper, Honda Jazz

Saloon

Four door cars with a separate boot, often offering comfort and refinement for longer journeys.

Examples: BMW 3 Series, Audi A4, Mercedes-Benz C-Class, Tesla Model 3, Jaguar XE, Skoda Superb, Lexus ES, Honda Accord, Volkswagen Passat, Toyota Camry

Estate

Extended versions of saloons or hatchbacks with increased boot space and practicality.

Examples: Volvo V60, Ford Mondeo Estate, Skoda Octavia Estate, Audi A6 Avant, BMW 5 Series Touring, Mercedes E-Class Estate, Peugeot 508 SW, Vauxhall Insignia Sports Tourer

SUV (stands for Sport Utility Vehicle)

Larger, taller vehicles offering more space, higher seating, and optional (never used) off-road capability.

Examples: Nissan Qashqai, Kia Sorento, Land Rover Discovery, Hyundai Tucson, BMW X5, Audi Q7, Skoda Kodiaq, Volvo XC90, Toyota RAV4, Ford Kuga

Crossover

A blend of a hatchback and SUV, crossovers are compact and suited to urban driving.

Examples: Ford Puma, Renault Captur, Nissan Juke, Peugeot 2008, Kia Niro, Hyundai Kona, Toyota C-HR, VW T-Roc, MG ZS, SEAT Arona

MPV (stands for Multi-Purpose Vehicle) sometimes called a People Carrier

Designed for families, these cars offer flexible seating and extra space for passengers and luggage.

Examples: Citroën Berlingo, Vauxhall Zafira, Ford Galaxy, Volkswagen Touran, SEAT Alhambra, Renault Scenic, Toyota Proace Verso, Peugeot Rifter

Convertible

Cars with retractable roofs, made for open top driving and enjoying the rare sunny weather in Great Britain!

Examples: Mazda MX-5, BMW Z4, Audi A5 Cabriolet, Mini Convertible, Mercedes C-Class Cabriolet, Porsche 911 Cabriolet, Fiat 500C

Coupe

Stylish two door cars with sporty design and sloping rooflines, often performance oriented.

Examples: Audi TT, BMW 2 Series Coupe, Mercedes CLA Coupe, Toyota GR86, Ford Mustang, Lexus RC, Porsche Cayman, Honda Prelude (classic)

Sports

High performance vehicles built for speed, handling, and driver enjoyment.

Examples: Porsche 911, Jaguar F-Type, Nissan GT-R, Aston Martin Vantage, Lotus Emira, Toyota Supra, Audi R8, Chevrolet Corvette, BMW M4

4x4

Vehicles built for rough terrain with four-wheel drive, high ground clearance, and rugged features.

Examples: Land Rover Defender, Jeep Wrangler, Toyota Land Cruiser, Suzuki Jimny, Mercedes G-Class, Ford Bronco, Mitsubishi Shogun, Isuzu D-Max (off-road trim)

City

Ultra compact cars designed for city driving, easy parking, and excellent fuel efficiency.

Examples: Fiat 500, Toyota Aygo X, Hyundai i10, Kia Picanto, Volkswagen Up!, Peugeot 108, Citroën C1, Smart ForTwo

Electric Vehicle (often referred to as an EV)

Fully electric cars available across most body types, offering zero emission driving.

Examples: Tesla Model 3 (saloon), Kia EV6 (crossover), MG4 (hatchback), Nissan Leaf (hatchback), Hyundai Ioniq 5 (SUV), BMW i4 (saloon), Renault Zoe (supermini), Volkswagen ID.4 (SUV), Polestar 2 (fastback)

Whatever it is that you drive, simply pop your registration plate into our site and we'll get your temporary insurance quote seriously fast and get you covered in minutes.

What cover and uses should I be aware of for UK temporary insurance?

Can you use temporary insurance cover for commuting?

Temporary insurance can be used to commute.

The definition of commuting for insurance purposes, means travelling to or from a single or permanent place of work, for either all or part of the journey i.e. driving to a train station as part of the commute.

If you have a job where you must travel to more than one single place of work, then you will need what is referred to as 'Business Use'.

Can you use temporary insurance for Business Use?

Unfortunately, you cannot use temporary insurance for Business Use purposes for your car.

The definition of Business Use is driving / commuting to multiple locations, such as visiting clients or prospects. It's again different to 'Commercial Use'.

Can you use temporary insurance on a car for Commercial Use?

You cannot use temporary insurance for Commercial Use on a car.

Commercial Use means using your car for transporting goods or people for what is referred to as 'Hire or Reward' which basically means when you're being paid for it, i.e. as a job / source of income.

Can I use temporary insurance cover in Europe?

Yes, you can use temporary insurance when driving your car in Europe, but you must start and end the journey in the vehicle in the UK.

Our temporary insurance is comprehensive but when you drive in Europe it will revert to the minimum level of cover required in that country.

Check what the minimum level of cover is in the country you’re travelling to / driving in, and whatever that is, is what the policy will provide.

As a general rule of thumb, the minimum level of cover required in most European countries is Third Party Only.

You must also double check the country you are travelling to is covered in your policy booklet.

You can view our IPID on our quote page before you purchase a policy which shows the country exclusions and inclusions.

You can view our Policy Wording on our declaration page before purchasing a policy, where you can read the full terms and conditions of the policy.

How do I know my car is insured when using temporary insurance?

When using a reputable and reliable temporary insurance provider such as Covertime you can be safe in the knowledge that you are properly insured.

We use a trustworthy panel of insurers, who are experienced in providing short term insurance to UK drivers.

Simply check your policy confirmation email that we send over to you and refer to the documentation contained within it for further info.

You can also look at the Motor Insurance Database (MID). The MID is the UK's official provider of insured vehicle data.

Due to the fast nature of temporary insurance, your policy may begin before your insurance is showing on the MID. As long as you have access to your Certificate, you are covered and safe to drive.

What levels of cover does short term car insurance have?

When you take out your annual car insurance policy you will usually select one of three levels of cover.

Either Comprehensive, Third-Party Fire & Theft (can be referred to as TPFT) and then the lowest level of cover that allows you to drive legally on UK roads, Third Party Only (sometimes referred to as TPO).

Third Party basically means people other than yourself, so if you have Third Party Only cover your insurance will only cover other people's vehicles, injury and property, not your own.

TPFT will be the same as TPO but also covers your vehicle for fires and theft.

Comprehensive is the higher level of cover of the three and covers you, your vehicle and the levels included in TPFT and TPO.

When you take out temporary insurance with Covertime, we only offer Comprehensive cover.

The Cambridge Dictionary states that the definition of the word comprehensive is 'complete and including everything that is necessary' which is why it's used in insurance terminology.

It covers you in the most complete way of all the three main levels of cover.

Pay securely and easily

Temp car insurance FAQs

Short term car insurance is completely flexible, not only does it allow you to drive the car of a family member or friend, it allows you to choose the exact amount of time you need to use the car for.

You can insure a car for as little as one hour to 28 days.

Yes. Temporary car insurance is added to the Motor Insurance Database (MID), which is the UK’s official record of insured vehicles. Because temporary policies are short-term, there can occasionally be a short delay before the MID updates. As long as you have your insurance certificate or confirmation email, you are legally insured and safe to drive

Yes, you absolutely can insure yourself on someone else’s car with temporary insurance, that is one of the main reasons people get it. Just make sure you have the owner’s permission.

Yes you can take out multiple temporary policies in a year, but there will come a tipping point that it would make more sense cost-wise to take out an annual policy.

No you can't take out temporary insurance on a hire vehicle. Short term insurance allows you to borrow a car and insure it, rather than insure a hire car.

You cannot legally drive a car home without insurance.

If you have an accident you won't be insured and the excuse that it's a new car and you haven't had chance to insure it yet, wouldn't cut the mustard.

You can use temporary car insurance or drive away insurance as it can also be referred to, to get a new car insured.

This way you can give yourself more time to find a competitive and suitable annual car insurance policy.

Yes you can use temporary insurance to tax a car - this is one of the beauties of short term cover. Remember that a car needs an MOT in order to tax it.

You can take out a temporary car insurance policy to get your car insured on the MID (Motor Insurance Database) then tax your car (as it has to be insured to tax).

You can MOT a car without tax. but the journey must be purely to and from the MOT test centre.

Brand new drivers ie you passed your test two days ago, unfortunately cannot get temporary insurance. But new-ish drivers can.

You need to have held your full UK driving licence for at least six months. So, if you've just passed your test, congratulations, but you'll need to wait for six months before you can get a temporary insurance policy.

Temporary car insurance is perfect for short term needs, but if you require coverage for a longer duration, an annual policy may be more cost effective.

It doesn't cover you for driving a rental or hired car; you'll need a specific hire car insurance policy for that.

Short term cover also is not suitable if you're planning on using it to be a cabbie - you'll need proper taxi insurance to do that. It's also not to be used for deliveries or courier work.

Temporary car insurance is also not suitable for releasing a vehicle from a Police or Local Authority impound, learning to drive, driving outside of the EU/EEA and for importing / exporting cars; the vehicle must be in the UK at the start and end of the policy.

With annual insurance you pay for the full 365 days of cover on your car insurance, whereas with temporary insurance you only pay for the time you need. That is why it's worth checking to see if a short term policy is cheaper for you.

There are also a few ways that you can try and get the cheapest temporary car insurance.

- Don't purchase adds ons you don't need; for example, you may have breakdown cover with your bank account

- Have a choice of cars to borrow? It might be worth getting quotes to see which car produces the cheapest quote for you

- Build your experience; the longer you've held your licence claim-free, the better

Temporary insurance UK is important as it can help drivers get emergency insurance to make sure they are legally covered whilst on the road in the UK.

If you drive a car that you are not insured on there could be big consequences if you are pulled over by the police.

The consequences could be even worse if you have an accident and are not covered by any insurance.

You could be left with severe consequences, such as large bills if you are found liable for any damage or injuries caused by you if you're at fault.

If you crash a car in the UK without insurance, you're breaking the law and could face serious consequences.

Driving without at least third-party insurance is illegal, and even if the vehicle is insured, you must also be personally insured to drive it.

If caught, you could receive a £300 fixed penalty and 6 points on your licence.

In more serious cases, you could face an unlimited fine, a driving ban, and the police may seize or even destroy the uninsured vehicle.

After purchasing your policy from us, you'll receive a set of important documents to view and download.

These include your Insurance Certificate (proof of cover), Policy Schedule (key policy details), Statement of Fact (information used to create your policy) and the Policy Wording (full terms and conditions).

You’ll also get an Insurance Product Information Document (IPID) for comparison purposes, our Customer Terms of Business, and the Covertime Contract, which outlines our role in arranging your policy and the admin fee payable.

There is no hard and fast rule for the cheapest cars to insure on a short term basis. As a rule of thumb within the UK insurance industry, smaller, cheaper and low powered cars usually command the lower premiums.

Therefore, used cars and cars with smaller engines are worth getting quotes for it you're looking for the cheapest temporary car insurance as a UK driver.

Cars that fall into this category could be the Hyundai i10, VW UP, Skoda Fabia, Kia Pacanto, SEAT Ibiza, Ford Fiesta, Fiat Panda or the Toyoto Aygo X to provide just a few examples.

Due to the fact that you can only insure a car for between one hour to 28 days on temporary car insurance, you do not earn No Claims Discount (or what some may call No Claims Bonus) with short term cover. No Claims Discount is earned after you have had a full year's worth of claim free driving on an annual policy, so this is why you don't earn it with temporary insurance in UK.

There is no standard approach for using security to get lower car insurance premiums and this is still the case with short term car insurance in the UK.

The best way to stop your car being stolen is to use multiple layers of security, as no single method of stopping your car being stolen is guaranteed or a 'silver bullet' solution.

You can use a car alarm, an immobiliser to stop the car being started, a tracker which can help you to find your car in the event of it being stolen, steering wheel locks or physical security such a bollard on your drive or keeping your car locked out of sight in a garage.

All security solutions can be got around if the thieves really want your car, but the more layers of security you have then better chance you have of stopping them or putting them off!

There's no doubt that keeping your car locked out of sight in a garage overnight is the best method of keeping it out of the hands of car thieves. Not only does it keep it from being spotted by opportunists but also put a barrier between them and your car that they'll need to get past without making a noise!

If you can't store your car in garage, then your drive is your next best bet; there isn't usually a physical barrier, but it'll be close to your home and will allow you to be nearby to hear any suspicious activity.

If you don't have a garage or a driveway, the final option is to keep your car parked on the road, which is the least desirable overnight storage location from an insurance perspective, as your car will be out of sight, won't be behind any sort of locked door and potentially not within as close a proximity to your house as a driveway.

When you get a temp car cover quote with Covertime, we use a registration look up which automatically passes us the information about your car. This means that you don't have to spend any time looking up details or working out its current value with depreciation since purchase, our clever system does all of the work for you.

Forget the days of calculating what was originally paid for the car, how old it is, the depreciation due to mileage, condition, demand etc. with Covertime you can get a temporary car insurance quote in less than 60 seconds with minimal input!

Most temporary insurance providers offer cover from one hour to 28 days; therefore, six months is a little past that.

Be aware that cancelling an annual policy part way through may incur a cancelation fee, you won't earn your year's NCD, plus your refund probably won't be for six months' worth of remaining cover.

Always check with your annual insurer before making these types of changes or cancellations; to find out what implications and costs are associated with it.

You can only obtain short term car insurance from us once you have a full licence. We will also require at least six months on your licence to be able to provide you with a short term car insurance quote.

Here at Covertime we required you to have a full UK driving licence to be able to take out temp cover on our car insurance. We cannot currently provide short term insurance for non-UK driving licence holders.

You can't drive a car on public roads without insurance. If you were to drive a car without insurance, it would be illegal, and you could see points on your licence or fines if you were caught.

If you're buying from a car dealer, then they may have cover for test rides included on their motor trade insurance, this could cover accompanied demonstrations or unaccompanied demonstrations cover.

For private sales, temporary car cover can be really useful to make sure you can test the car that you're considering purchasing but ensure that you are properly insured to do so and not driving it illegally.

Yes, you can insure yourself on a friend's car with temporary insurance for a car in the UK! If you want to drive a friend's car, then you can get a short term car insurance quote from us today and get on the road in minutes; it doesn't take very long at all to get a quote, most people do it under 60 seconds when you have all the relevant details to hand such as your driving licence and car registration!

By using short term car insurance UK, you can absolutely insure yourself safely and legally on a car you don't own.

The biggest benefit to this is that you only have to insure yourself on it for the time you need, so you can potentially save money by insuring only for the time you're driving.

Should you need to drive the car for a little longer than expected, then you can simply purchase another new temporary insurance policy and get to your destination, insured comprehensively.

We will send you a policy expiry email ahead of your policy finishing, so you can follow the link back to our site to obtain a new policy if needs be.

You cannot transfer temporary cover to another car or person. As temporary insurance is so easy and flexible, you would just take out another policy for the other car or other person on a short term basis.

If your previously policy is no longer needed and the inception time hasn't started, then you can contact us for a potential refund if no cover has commenced.

Unfortunately, you cannot insure a modified or custom car using our temporary insurance. This is because a modified car could have performance enhancing modifications which are unacceptable to our insurer panel for their short term policy underwriting criteria. Modified cars can have a different value or power to their manufacturer specifications that our premiums are calculated on.

You can insure more than one vehicle with temporary insurance, but you will need to insure each vehicle on its own policy.

Therefore, you could have one temporary policy on one car and then have another temporary policy on another car.

It may well be a pretty unusual situation where this would occur, but it is possible.

We try to make everything so easy to do here at Covertime you don't actually need to speak to us.

However, we are available on Live Chat and email and if that doesn't suit your needs, then you can get in touch with us.

We can call you via telephone, but we will not be able to administer the policy for you.

You’ll need to get a quote for your temporary insurance online; our quote journey takes less than one minute to get a price!

When you take out a short term car insurance policy with us, we will send you all of your insurer documentation via email immediately.

If you’re involved in an incident that may result in a claim, contact your insurer directly as they will handle the process.

Claims should be reported as soon as possible. If you need help, our team is here to assist.

There are various different advanced driver courses in the UK that you can attend. These include various courses offered by IAM Road Smart including their Advanced Driver Course, Young Driver Assessment and Mature Driver Review; you can also use other providers such as the Pass Plus Scheme or RoSPA Advanced Driving Course.

These courses could be of great value to improve your driving and keep you safer on the roads, but unfortunately, they won't provide a discount for your short term car insurance.

As a new company, we are concentrating on our main offering which is temporary insurance.

However, we have various optional extras for our temporary insurance policies in the pipeline.

These may include Legal Expenses which would help to cover uninsured losses in the event of a claim where you are not at fault, such as reclaiming the costs of your excess payments.

We are also looking into providing breakdown cover for your temporary insurance, to help you get back on the road or to your destination if you have issues with your car.

Temporary insurance UK may be a cheaper solution because you're only paying for the exact time you need cover. Whether it's for an hour, a day, or a few weeks. Unlike annual policies, you’re not tied into long term contracts or paying for unused cover.

Many temporary insurance providers in the UK use streamlined digital platforms to reduce admin costs, making policies more affordable and flexible for drivers.

There are a number of insurers in the who underwrite temporary car cover policies in the United Kingdom.

These include, but are not limited to: Allianz, KGM, Eridge, Somerset Bridge, First Underwriting, ERS, Haven, Granite and Aviva.

Yes, of course you can absolutely insure a car for occasional usage. It's why we exist and probably why you're on our website!

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.