Two Day Car Insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

Two day car insurance in minutes

Need to borrow a car for a couple of days? Our two day car insurance gives you comprehensive cover fast, ideal for short term use of your own car or someone else’s. Whether you’re helping a friend move house, taking a weekend road trip, or need cover while your main car is in the garage, we’ve got you covered.

You can buy your 2 day car insurance policy online in minutes. It can start instantly or on a future date within the next 30 days. You only pay for the time you need - no long term commitment required.

With Covertime’s two day car insurance, you’ll be protected against damage to your car, other vehicles, and other people... all with one simple policy.

Short term car insurance can be seriously handy for lots of different situations such as:

Driving a friend's or family member's car to help them out or for your own use

Driving a new car home before you sort an annual policy

Test driving a new car before you buy it

Driving a second car that you don't use very often

Sharing the drive on a long trip

Using a car in an emergency

Our two day policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear; claims relating solely to the damage of glass (windscreen repair)

How to get two day car insurance

Getting two day car insurance really couldn't be easier!

Forget the days of filling out pages of relentless questions for your annual car insurance quote. With our simple quote process, you can get a quote for two days car insurance in a couple of minutes in just a few simple steps...

1

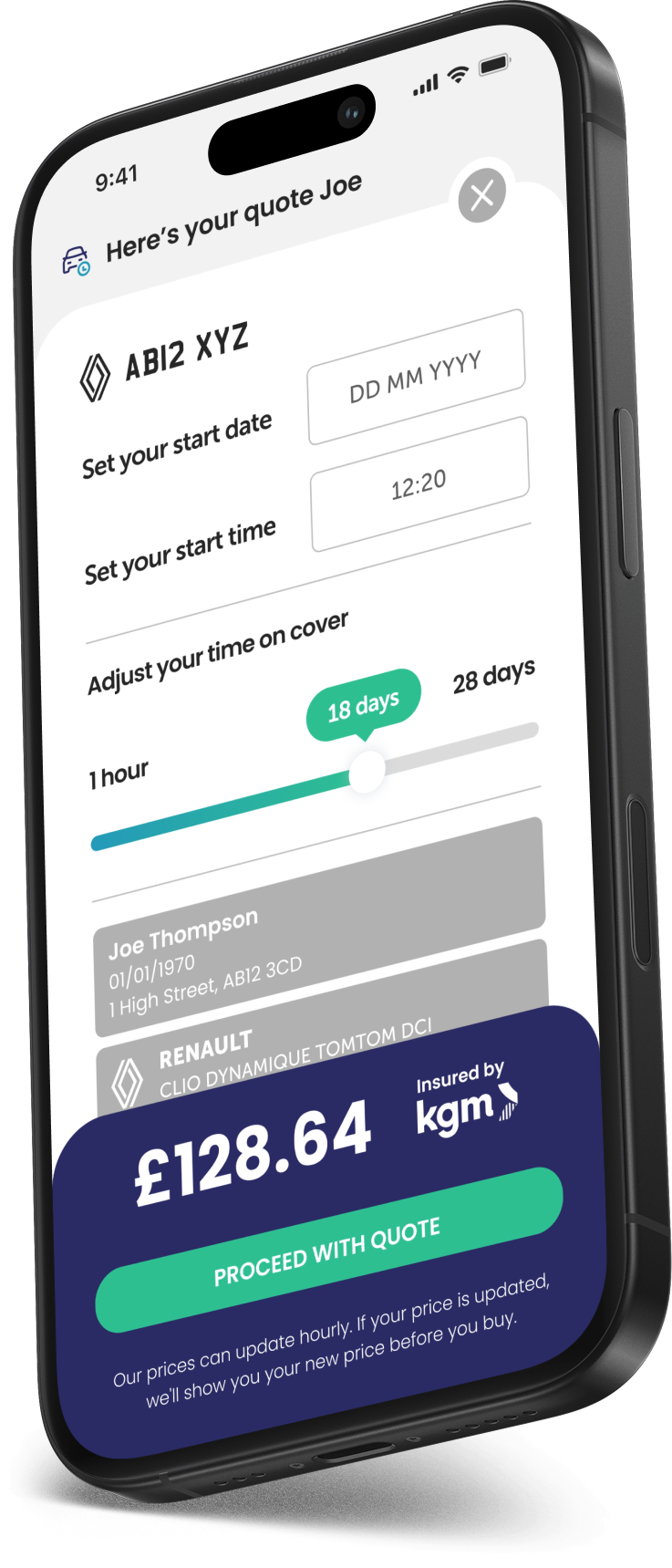

Just let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs two day car insurance?

Many drivers assume that having a comprehensive car insurance policy means they can drive any other car, but that’s not always the case.

Some annual comprehensive insurance policies include a feature called Driving Other Cars (DOC), which may allow you to drive someone else's car. However, this cover is not standard and is usually only intended for emergencies, not everyday use.

DOC cover is becoming less common and often comes with strict conditions. For example, drivers under 25 are rarely eligible for it. Even if you do have DOC, it usually only provides third party only (TPO) cover, meaning you would not be covered for damage to the car you are driving.

Always check your policy documents or speak to your insurer to be sure before driving another car.

When you drive someone else’s car under Driving Other Cars (DOC) cover, it’s important to understand that the protection level drops. Instead of having full comprehensive cover, you’ll only be insured for damage to other vehicles or injuries to other people if there’s an accident. This is known as Third Party Only (TPO) cover.

If you don’t have your own insurance policy, another option is to be added to someone else's insurance as a named or additional driver.

Keep in mind, though, that if you need to make a claim as a named driver, it will affect the main driver's No Claims Discount, also known as a No Claims Bonus. This could lead to a higher renewal price for them.

If you only need to use a car for two or three days, then choosing a Covertime two day car insurance policy could be more convenient. It also avoids risking the car owner's No Claims Discount; which will give them peace of mind when you borrow their car. If you need less than two days, you can choose how much cover you need by the hour!

Who is two day car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does two day car insurance cost?

The price of two day car insurance depends on several factors, including your age, driving history, location, the vehicle you want to insure, and when you need cover.

Insurers also consider how long you need the policy for: in this case, just two days, which can help keep the cost lower compared to longer-term policies.

If you only need to drive a car for a couple of days, a two day temporary car insurance policy could be a cost-effective solution. It gives you the flexibility to get behind the wheel without committing to a full annual policy.

You can take out multiple short term car insurance policies throughout the year, but if you're regularly using the same car, switching to an annual policy may work out cheaper in the long run.

How can I lower the cost of two day car insurance?

The key to finding cheap two day car insurance is simple: only pay for the exact time you need to be insured. 2 day car insurance gives you the flexibility to start your policy whenever you're ready to drive and end it exactly when you're done.

By only insuring yourself for two days, you avoid paying for unnecessary cover, which helps keep costs low. It’s ideal if you just need short term use of a vehicle, whether it’s your own or someone else’s.

You can choose cover from just one hour up to 28 days. If you need more time after your two day insurance ends, you can simply take out a new short term policy to stay protected. Simplest way to start is to get a quote for daily car insurance.

Benefits of two day car insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Two day car insurance FAQs

Yes, you absolutely can insure yourself on someone else’s car for two days with temporary car insurance, that is one of the main reasons people get it. Just make sure you have the owner’s permission.

Yes you can take out multiple two day car policies in a year, but there will come a tipping point that it would make more sense cost-wise to take out an annual policy.

If you passed your driving test within the last six months, temporary car insurance isn’t available to you yet. Most insurers require you to have held a full UK driving licence for at least six months before you're eligible.

So while brand new drivers can’t get two day car insurance straight away, once you've had your licence for six months and gained a bit of experience, you'll be able to take out a short term policy for the exact time you need. Perfect for when you only need to borrow a car for a couple of days.

Temporary car insurance is perfect for short term needs, but if you require coverage for a longer duration, an annual policy may be more cost effective.

It doesn't cover you for driving a rental or hired car; you'll need a specific hire car insurance policy for that.

Short term cover also is not suitable if you're planning on using it to be a cabbie - you'll need proper taxi insurance to do that. It's also not to be used for deliveries or courier work.

Temporary car insurance is also not suitable for releasing a vehicle from a Police or Local Authority impound, learning to drive, driving outside of the EU/EEA and for importing / exporting cars; the vehicle must be in the UK at the start and end of the policy.

With annual insurance you pay for the full 365 days of cover on your car insurance, whereas with two day car insurance you only pay for the time you need. That is why it's worth checking to see if a short term policy is cheaper for you.

There are also a few ways that you can try and get the cheapest car insurance for two days.

- Don't purchase adds ons you don't need; for example, you may have breakdown cover with your bank account

- Have a choice of cars to borrow? It might be worth getting quotes to see which car produces the cheapest quote for you

- Build your experience; the longer you've held your licence claim-free, the better

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.