Temporary Insurance for Sharing a Car

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is car sharing insurance?

Car sharing insurance gives you quick and easy short term coverage for sharing the driving.

Whether it's your own or a car that belongs to a friend or family member, you can get insured quickly to share the driving for the exact amount of time you need. It can start immediately after you've paid or a chosen point within 30 days.

Our car sharing insurance is comprehensive so it will cover you, the car you're driving, as well as other people, property and other vehicles.

Car sharing insurance is great if one person doesn't want to do all the driving and could come in useful for the following situations:

Going on a long road trip

Attending a festival or concert

Holiday travel with friends or family

Special celebrations and events

Travel to or from university

Weekends away

Our sharing policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

How to get car sharing insurance

Getting insurance for sharing the drive is super easy!

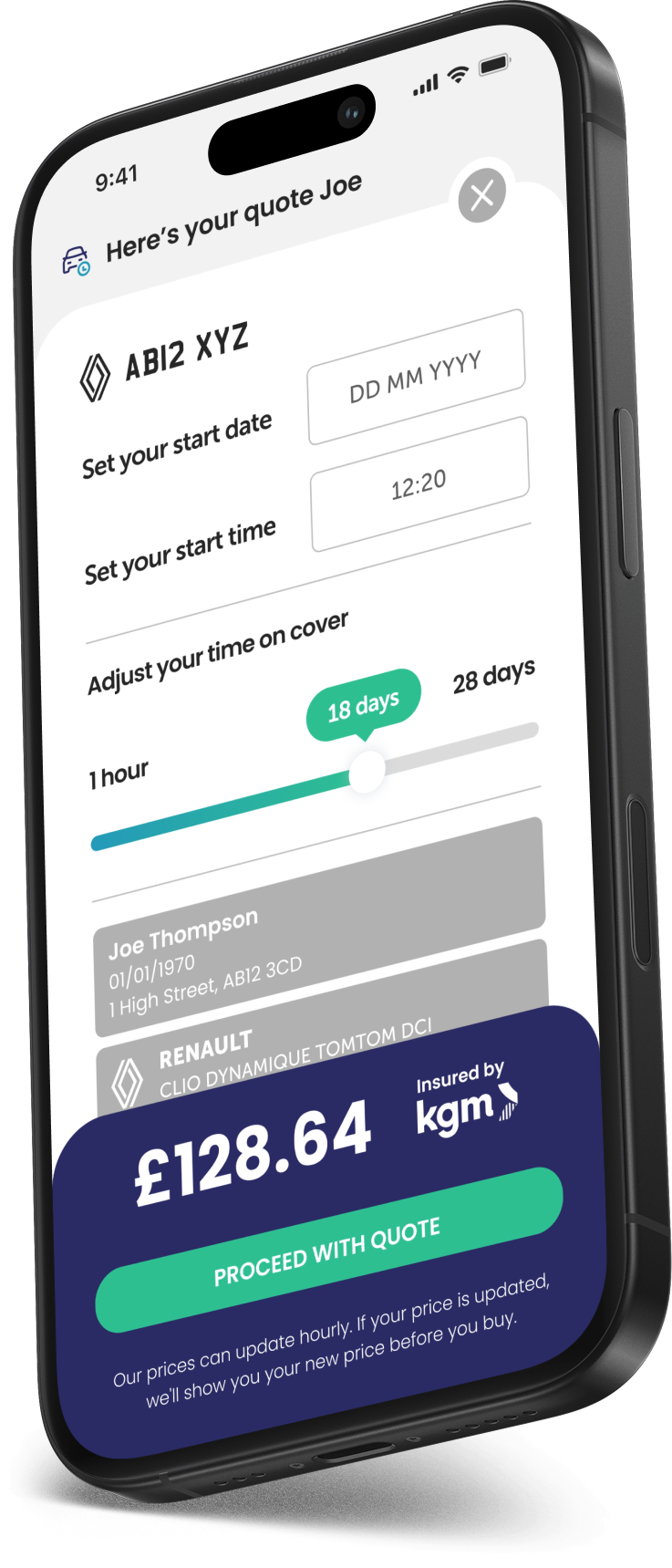

Our simple quote process for temporary car sharing insurance means you can get a quote in no time with just a few simple steps...

1

Just let us know reg of the vehicle you're sharing and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need car share insurance?

Before sharing the driving for any journey, it's important that you have the right insurance in place. Not all comprehensive insurance policies allow you to drive another car so don't make the mistake of assuming this

If you already have an annual comprehensive car insurance policy in your name, you might be covered to drive someone else's car under the 'Driving Other Cars' (DOC) rules.

However, this is not standard and not everyone has this cover in their Comprehensive policy. If you do have DOC, it is only meant for emergencies and not regular use.

Drivers under the age of 25 will not usually have DOC cover, so make sure you check with your insurer before choosing the share the drive without taking out a separate specific policy.

It's important to be aware that when you share the drive using someone else's car under Driving Other Cars, the cover changes from Comprehensive to only covering damage to the other car or other people if you have an accident - referred to as Third Party Only (TPO).

If you don't have your own insurance then you can be added as a second driver or 'named driver' to another person's policy.

However, if a second driver has to make a claim on this policy then it would impact the main driver's No Claims Discount (also known as No Claims Bonus). It could potentially increase their insurance premium at renewal.

This is why it can be a great to choose temporary car sharing insurance for one off trips or events.

Our car sharing insurance can provide you with specific cover from one hour to a few days, a couple of weeks to 28 days and takes less than a minute to get a price.

Who is car sharing cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does share a car insurance cost?

Car sharing insurance can be an affordable way to get on the road insured. If you only need to share the drive for a short amount of time, a single trip or just a few days then temporary cover to drive a shared car can be ideal.

The cost of a car sharing insurance quote will will depend on things such as your age, experience, where you live, when you need cover, the car you'll drive and how long you need to drive it for.

How can you get reduce the cost of car sharing insurance?

If you only take out the exact amount of time on cover that you need to drive the car you're sharing, then you can keep your car sharing insurance premium to a minimum.

Choose from as little as one hour all the way up to 28 days. If you need more time after one policy ends, then you can take out new temporary car policies to cover your car sharing.

Benefits of share a car insurance

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for long journeys

Planning on taking a trip with lots of driving? Then spread the load with car sharing insurance

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Car sharing insurance FAQs

Temporary car sharing insurance is a fully flexible solution to borrowing, lending and sharing a car. You can select the amount of time you need, so you don't have to pay for cover when you're not driving.

You can insure a car you're sharing the drive on for as little as one hour to 28 days.

With car sharing insurance, you can drive someone else's car insured. It's a form of temporary insurance and allows short term cover on a car that you might be going on a trip with and want to share the long driving stint!

Yes you can take out multiple temporary policies for the purpose of sharing the drive in a year, but there will come a point that it would make more sense cost-wise to take out an annual policy if you're always using the same car.

You'll need to have held your UK driving licence for six months to be able to get car sharing temporary insurance.

With annual insurance you pay for the full 365 days of cover on your car insurance, whereas with temporary car insurance you only pay for the time you need. That is why it's worth checking to see if a short term policy is cheaper for you.

There are also a few ways that you can try and get a lower quote for your temporary car share insurance.

- Don't purchase adds ons you don't need; for example, you may have breakdown cover with your bank account

- Have a choice of cars to borrow? It might be worth getting quotes to see which car produces the cheapest quote for you

- Build your experience; the longer you've held your licence claim-free, the better

Did you know?

If you add a driver to a car insurance policy, any claims made by that additional driver will affect the main policy holder's No Claims Discount.