No Claims Discount Explained

A No Claims Discount (NCD), also known as a No Claims Bonus, is a reduction in premium as a reward for not making any claims on your insurance policy. The longer you go without having to make a claim, the bigger the discount year on year.

It’s a nice little bit of jargon you hear whenever you look into purchasing a car insurance policy, but what does a No Claims Discount (NCD) or a No Claims Bonus (NCB), actually mean?

In this article we'll aim to explain all things No Claims Discount - how it works, how you can protect it, and what happens to it when you take out short-term insurance cover.

How does a No Claims Discount work?

Each year you go without making a claim, is another year added to your NCD. The exact discount you would be entitled to varies from insurer to insurer, but these can range in discounts from 30% - 70% off your annual premium.

It is not a legal requirement for insurance companies to provide a no claims discount, but most in the UK will do. In fact, how different insurers run their No Claims schemes can vary quite a bit, so it’s important to make sure you’re shopping around for the best deal for you.

Does No Claims Discount expire?

It's a good question!

The great thing is, as long as you stay insured and don't make a claim, your no claims discount should remain in place! You should be able to keep the same number of no claims discount years if you switch providers, but keep in mind that the actual discount applied may differ between insurers.

As long as you’re staying insured your no claims discount should be fine, but if you go without insurance for a long period, say for more than two years, you may have to start over or accept a reduced NCD when you take out a new policy. Again though, this is up to the discretion of the insurers.

What happens to my NCD if I end up making a claim?

In the unfortunate event that you do need to make a claim and you are at fault, or where the insurer cannot recover costs from another party, your No Claims Discount may be reduced or lost.

For example: One claim could reduce your No Claims Discount by two years, or multiple claims in a short period may result in the No Claims Discount being reset to zero.

However, in the event the claim is due to an accident where the other driver is at fault and their insurer pays for the damages, your No Claims Discount could remain unaffected, but again, this varies between insurance providers.

Can you transfer your No Claims Discount to a new insurer?

Helpfully, most UK based insurers will allow you to transfer your No Claims Bonus if you choose to switch insurance providers. Your new insurance company will often require proof of No Claims Discount, which is typically in the form of a renewal notice or letter from your previous insurer. Some insurers also allow a period of time where your No Claims Discount remains valid, even if you haven’t had a car on the roads for a while. It’s worth noting that this is very rarely the case if your time without a car is more than two years.

How to protect your No Claims discount

Many insurers now offer optional 'No Claims Discount Protection’. This allows drivers to make a predetermined number of claims without losing their discount. This option of protection typically comes at an additional cost to your premium and does have limitations on the number of claims allowed before the discount is reduced or removed.

Does Temporary Car Insurance Affect Your NCD?

No, thankfully it does not. One of the most helpful things about a temporary car insurance policy is that it does not affect your existing No Claims Discount.

If you are borrowing someone else's car and end up needing to make a claim, it will also protect their No Claims Discount as well.

Can I build up my own No Claims Discount as a named driver on someone else’s policy?

No you won’t be able to build your own No Claims Discount when you’re added to someone else’s policy as a named driver.

So that's your No Claims Discount in a nutshell!

Buying a new car can be a super exciting experience, but sometimes all the legal requirements and insurance jargon can get a bit complicated. Most insurance companies will make sure they have lots helpful information on their websites, so it's important to have a good read over everything before choosing a policy. Always remember to ask questions if it's something you're unsure of, and shop around before you buy to make sure you're getting the best deal for you.

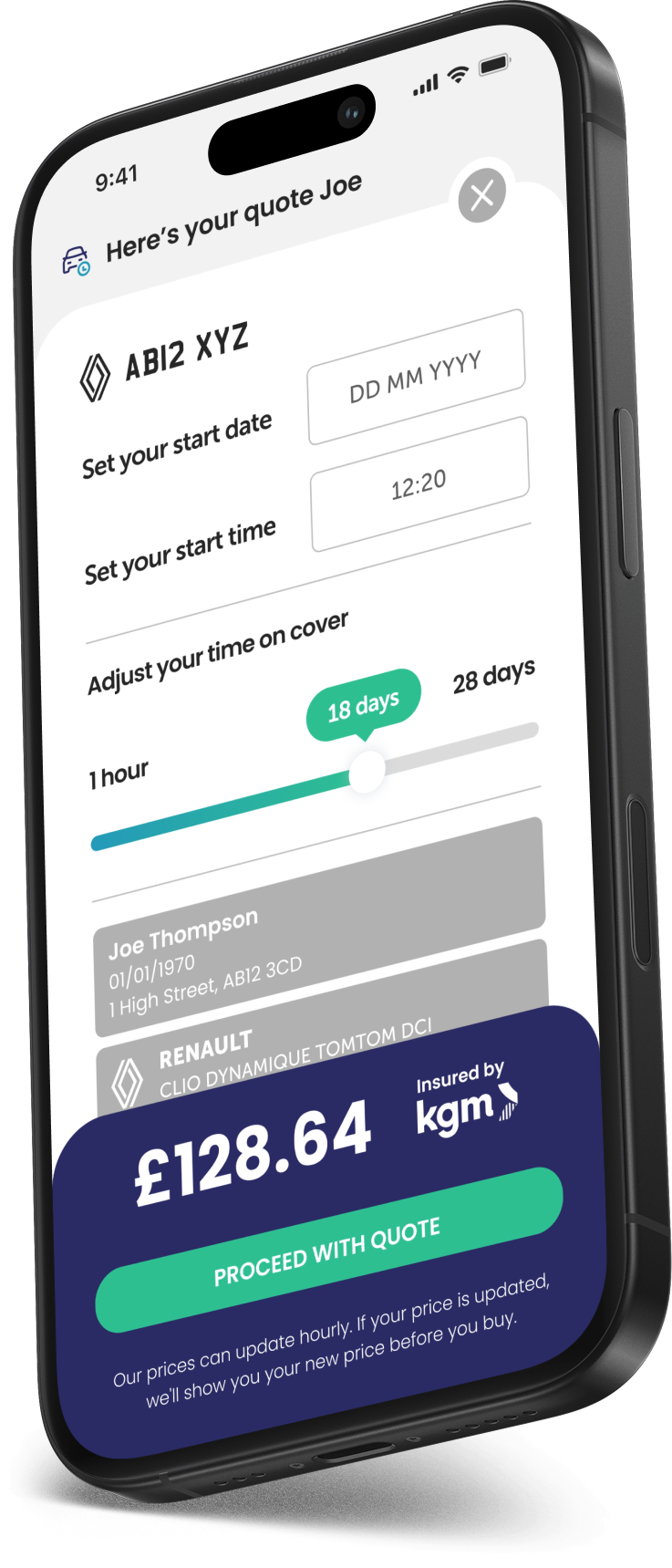

If you've recently bought a new car and need to bridge a gap in your annual coverage, you can get a quote for drive away insurance in minutes online for however long you need it - whether that's for an hour up to 28 days!