Temporary student car insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

What is temporary student car insurance?

If you’re a student at university or college there’s a good chance you don’t own your own car.

But what if you have a driving licence as well as a very kind friend or family member who will lend you their car?

With Covertime’s temporary student car insurance you can get fully insured on a car for a short amount of time, from one hour to 28 days.

Perhaps you're back home from university for the holidays and want to borrow your parent's car?

Perhaps you have a friend who is lucky enough to own a car and they want to share the driving on a road trip?

Maybe you’re a student who lives at home and have a car you can use from time to time for shopping trips or days out?

Whatever your reason for needing temporary car insurance as a student, we‘ll do our best to find you a good deal.

Driving a friend's car whilst at uni

Driving your parent's car when you're back at home

Driving a family member's car

Sharing the drive on a long trip

Using a car in an emergency

Our student policies are Comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

Who is temporary student car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How to get temporary student car insurance

If you’re a student, then you’ve got better things to be doing than trawling through time-consuming annual insurance forms, such as studying, attending lectures or chilling / partying with friends!

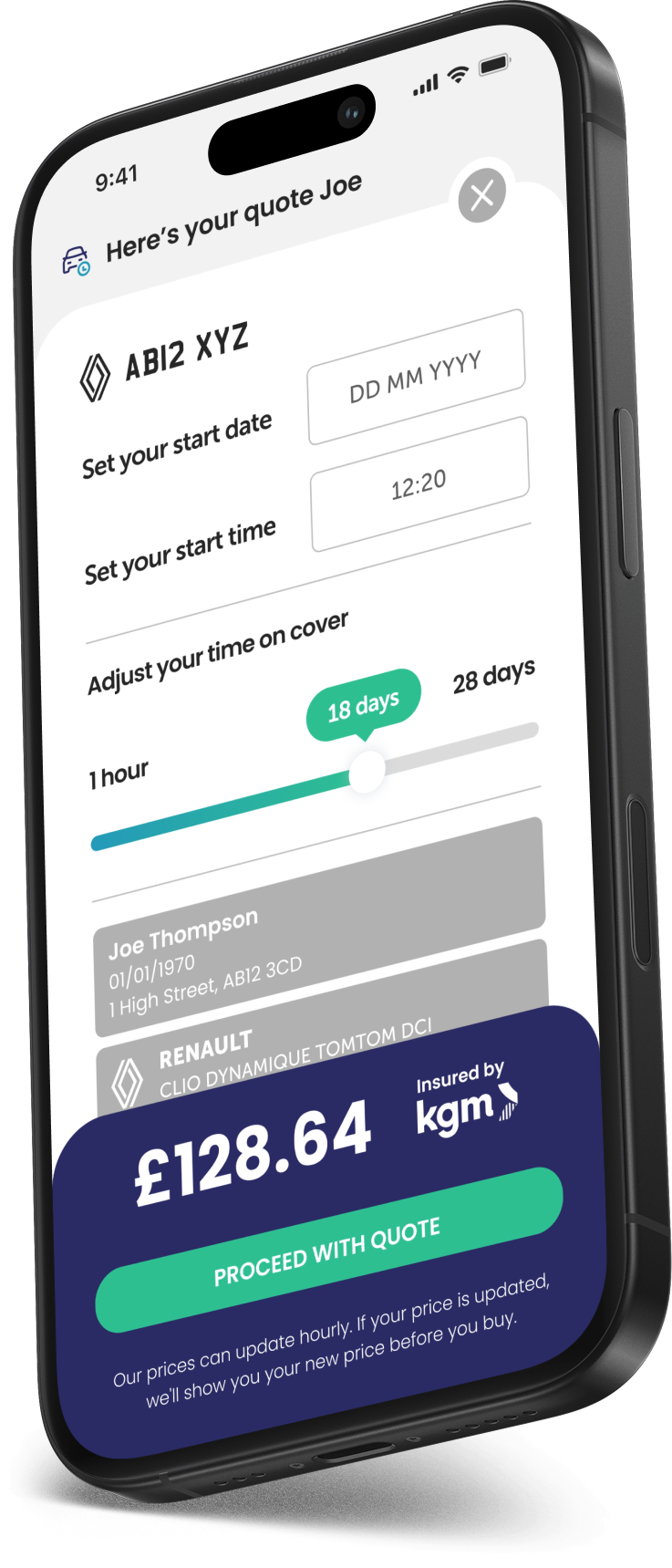

At Covertime we’ve tried to make our process for obtaining a quote for short term student cover as quick and easy as possible.

Simply follow a few steps and you can find out your price in a couple of minutes – if you like what you see then you can pay online too and be on the road within no time:

1

Just let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need temporary student car insurance?

A temporary student car insurance policy is built to provide university students with coverage only when they need it, instead of an annual car insurance policy.

Temporary policies for students are unbelievably quick to get a quote for, it’s super flexible and could save you money by only insuring the car you’re driving for the exact length of time you need.

Whether you’re traveling to and from university or using a friend’s or family member’s car during holidays, temporary student car insurance can give you the short term cover you need.

You can get insured by the hour, 24 hours, days or weeks, all the way up to 28 days so there's no need for a long-term commitment but you can insure yourself for enough time to get away for a weekend, take a road trip, do some shopping or even in an emergency.

If you only need to use a car for a short period of time, then choosing a Covertime temporary student car insurance policy could be really convenient. It also avoids risking the car owner's No Claims Discount; which should give them peace of mind.

How much does temporary student car insurance cost?

Insurance premiums always take in a variety of factors when calculating how much they will cost for an individual.

Students can often be younger drivers who may not have held their UK driving licence for a long period of time, this can sometimes mean that due to a lack of experience your premium could potentially be higher than someone with more experience.

The great thing about temporary student car insurance is that you only pay for the time you need, so you’ll only need to pay for a proportion of time rather than 365 day cover with an annual policy.

How can you reduce the cost of temporary student car insurance?

The golden rule to lower the cost of temporary car insurance for students is to buy the cover for the time you need.

The beauty of temporary student car insurance is that you can insure yourself at the exact time you need to start driving and set it to end when you need it to.

By only insuring yourself on the car for the time you need to drive it, you can keep your short term car cover costs to a minimum.

Whether you've borrowed a car from a friend or a family member because your back from university or during term time, you can choose from one hour to 28 days.

If you need more time after one policy ends, then you can take out new temporary car policies.

Temporary student car insurance

Takes less than 60 seconds!

Benefits of temporary car insurance for students

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term car insurance protects you, your passengers, your car as well as other people, property and vehicles.

Great for emergencies

In a hurry? Get on the road in minutes, driving a car you don't own (with the owner's permission of course!).

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive to keep costs to a minimum.

Pay securely and easily

Temporary student car insurance FAQs

Temporary student car insurance is seriously flexible, so you can choose how long it can last. If you're back from University or during term time, you can select one hour up to 28 days! Simply select the duration that suits you best... try daily car insurance if you only need one day.

Yes, if you're at university and one of your friends has a car there, you can get insured on it, with their permission of course! That way they don't have to do all the driving if you decide to take a longer trip.

With temporary student car insurance you only pay for the time you need, so you don't need to pay for the full 365 day's worth of cover as with an annual policy. It's well worth checking to see if a short term policy is cheaper for you, especially as a student.

You might be back from uni and at home with your parent's and able to borrow their car. Select the shortest amount of time on cover that you require in order to keep your costs down.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.