Two Week Car Insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Do everything online

Insure only for the time you need

Comprehensive cover

Docs available immediately after purchase

Protect existing No Claims Discount

Cover from one hour to 28 days

Get on the road in minutes

Quick and flexible

Everything you need to know about 2-week car insurance

Two-week car insurance? We can do that.

If you need to insure a car for a little longer than a few days, but don’t want the commitment of an annual policy, 2-week car insurance is a flexible solution. Whether you’re heading off on a two-week break, borrowing a car short term, or need cover while you sort out something more permanent, 14-day cover keeps things straightforward.

Instead of paying for months you won’t use, two-week car insurance lets you stay insured for two full weeks, with no long contracts or ongoing commitments. It’s ideal for drivers who need breathing room and flexibility, without the cost or hassle of a full annual policy.

Two-week car insurance is exactly what it sounds like: temporary car insurance that runs for 14 days, starting and ending at times that suit you. You get comprehensive cover for the entire period, then the policy ends automatically when it’s no longer needed.

Moving house, especially when one weekend isn’t enough

Travelling for work over a short assignment

A two-week holiday or staycation, with full peace of mind

Borrowing someone else’s car for a short period

Bridging a gap in annual coverage

Our 2-week insurance policies are comprehensive

What is covered?

Damage to the car you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the car unlocked

Wear and tear

How to get 2-week car insurance

The good news is, getting 2-week car insurance online is simple and only takes a few minutes – at Covertime, we keep things straightforward.

We don’t waste your time with long, drawn-out forms. We only ask for the information we need to get you covered, while our technology takes care of everything else behind the scenes.

Need cover instantly? No problem. Just choose to start your 2-week cover right away, and you can usually be set up and on the road within minutes.

If you’re more organised and arranging cover in advance, you can select the exact date and time you’d like your 14-day policy to start, up to 30 days ahead.

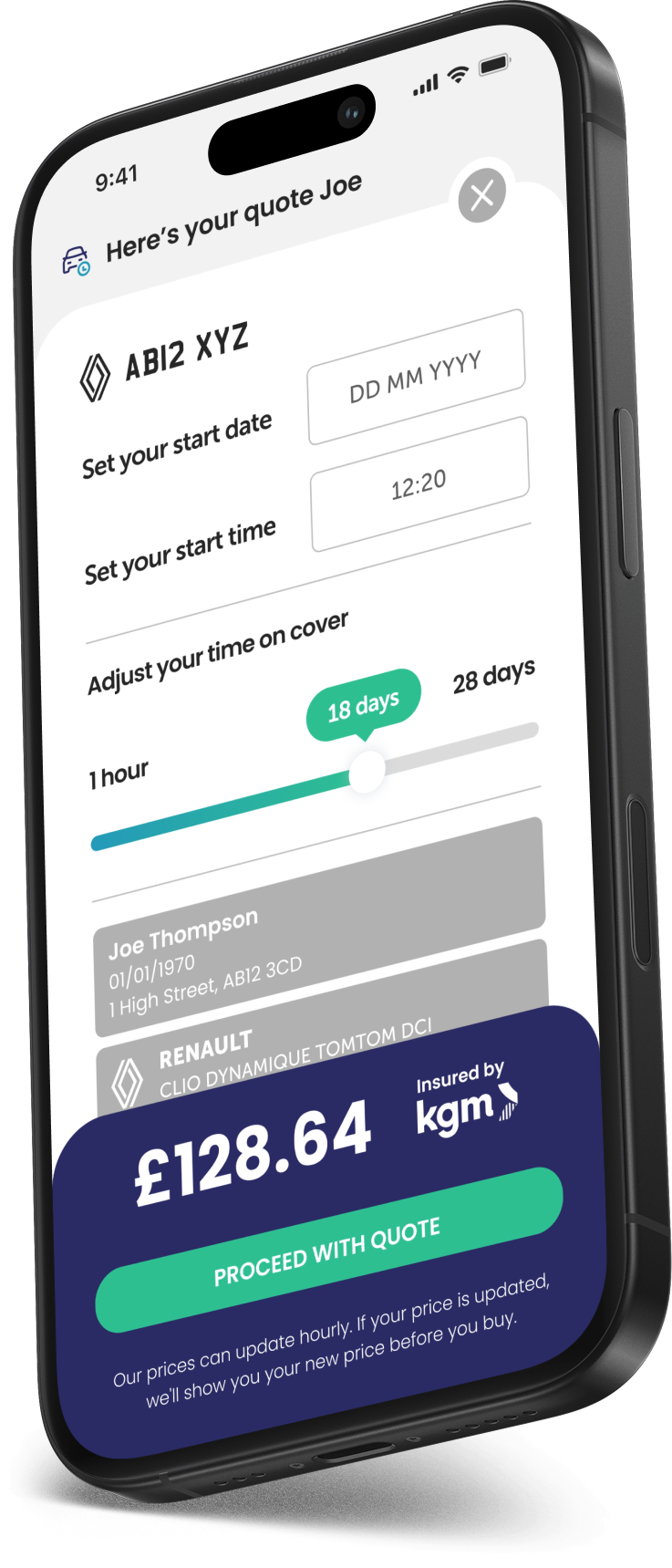

1. Just let us know the vehicle registration and a few details about yourself

2. Tell us when you need the cover to start, and that you want it for two weeks

3. Get your quote, check the terms, choose how you want to pay, and you’re good to go!

1

Just let us know the vehicle reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Who needs 2-week car insurance?

Two-week car insurance is a convenient option for drivers who want flexibility without committing to a long-term policy.

You might be borrowing someone else’s car for two weeks, welcoming visitors who are staying short-term and may need to drive, or using a temporary replacement vehicle while your usual car is off the road. It’s also a practical solution if you’ve recently bought a car and need to bridge the gap until your annual insurance is set up.

Whatever the situation, being able to take out temporary car insurance for two full weeks can make life simpler, giving you reliable cover for exactly the time you need, with no long-term commitment.

Who is 2-week car cover suitable for?

Personal use

Ages 21-75

Full UK licence holders

Vehicle value from £1,500 to £65,000

*Other terms and conditions apply.

How much does 2-week car insurance cost?

Two-week car insurance is a cost-effective option if you only need to insure a car for a short period, as you’re paying for 14 days of cover rather than committing to an annual policy.

The cost of 2-week car insurance depends on a few key factors:

About you | your car | when cover starts | the 14-day duration

Our quote process is quick and straightforward. We only ask for the details needed to calculate your premium, including:

How long you need cover for (14 days)

Duration plays a big role in price. Two-week cover costs more than a few days, but can work out better value than stacking multiple shorter policies.The car you’re driving

The make, model, engine size, and value of the car all influence the cost of cover.You and your driving experience

Your age, how long you’ve held your licence, and your driving history will also affect your premium.

How can you get the cheapest 2-week insurance?

To get the cheapest 2-week car insurance, make sure you only pay for the exact 14 days you actually need.

Two-week cover lets you start your policy at the precise time you plan to begin driving and set it to end as soon as those 14 days are up. This helps you avoid paying for unused time and keeps costs down.

You can choose cover from as little as one hour all the way up to 28 days. When getting a quote, use the slider to adjust the duration and make sure you’re getting the best value for the exact amount of time you need on cover.

Benefits of 2-week short term insurance

Choose your time

You can now choose how long you need cover, whether it's one week or two - why pay for more?

Comprehensive cover

Our weekly car cover protects you, your passengers, your car as well as other people, vehicles and property.

Great for new car purchases

Sort out insurance for a new car on a weekly basis, quickly and easily, from wherever you bought your new vehicle.

Quick, easy and affordable

Covertime is proudly faff-free! Get a quote quickly and keep costs to a minimum.

Pay securely and easily

2 Week Car insurance FAQs

Need car insurance for a week? It's absolutely possible.

Yes, absolutely. You can take out 2-week car insurance with Covertime for exactly 14 days, or choose any duration from one hour up to 28 days if that suits you better. You’re in control of how long you need cover for, without committing to a minute more than necessary.

Yes. As long as the driver meets the eligibility criteria and you’re happy for them to use your car, you can insure someone else to drive it for two weeks. This can be a quick, simple, and cost-effective option, especially if family or friends are visiting short term. It also helps you avoid the hassle of adding them as a named driver on your annual policy and won’t affect your no-claims discount.

When you take out 2-week car insurance with Covertime, you’ll always know exactly when your cover starts and ends. After purchase, you’ll receive a policy confirmation email with a link to all your documents, clearly showing the start date, end date, and duration of cover. We’ll also send you a reminder before your policy expires, so you’re never caught out without insurance in place.

If you’re borrowing someone else’s car, it is a legal requirement to make sure you are correctly insured.

Even if their car is insured already, that doesn’t mean that you are personally insured to drive it, and the same principle applies if you already have a car insurance policy in place – you shouldn’t assume you’re covered to drive someone else’s car.

Make sure you know what's covered on your annual policy by reviewing your policy documents. Whilst some comprehensive annual policies can provide DOC (Drive Other Cars) cover, this is not always the norm and does often come with a few caveats.

Temporary or short-term car insurance can be a simple and often cost-effective way to get insured to drive someone else’s car for a week.

If you're looking to borrow the car for a short period of time or just a one-off, temporary car insurance is fully comprehensive, and it won’t affect your no claims bonus which is certainly a bonus in itself!

At the moment our policies cannot be extended and do not renew. Don't worry though, we won't stand between you and the open road - you can purchase a new policy for another week, or just a few more hours by getting a fresh quote anytime, for however long you need it.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.