Can you get temporary insurance without a main policy?

You can obtain temporary car insurance without needing a main annual policy, which is sometimes referred to as an underlying policy. Temporary insurance allows you to drive a car for a short period of time, whether you're borrowing one, transporting a newly purchased car, or bridging the gap between annual policies.

Temporary insurance doesn't require an existing annual policy as it functions independently.

Even with the option of temporary insurance, all vehicles must either be insured or declared off-road (SORN) at all times.

What is an underlying policy?

An underlying policy refers to the primary insurance coverage for your car. When you initially insure your vehicle, this becomes your main policy, responsible for covering any claims you may make.

Your main underlying policy would cover you and perhaps your spouse or partner. You could then use temporary insurance to cover an additional drivers such as a friend or one of your children borrowing your car for a short amount of time.

You need an underlying policy on your car, as car insurance is a legal requirement unless you have SORN your car.

What is SORN?

SORN stands for Statutory Off-Road Notice and means that you have declared your car to be 'off the road' and it would therefore not need to be insured.

It is a declaration made to the DVLA (Driver and Vehicle Licensing Agency) in the UK when you take a vehicle off the road. This means the vehicle is not being driven or kept on public roads and is instead stored in a garage, driveway, or private land.

- SORN allows you to stop paying vehicle tax and insurance for a vehicle that you aren't using.

- You should make a vehicle SORN if it is untaxed, uninsured or you plan on breaking it down and using it for parts

- You can apply for SORN online, over the phone or by post

- Once your vehicle is SORN you cannot drive it on public roads, unless it is travelling to or from a pre-booked MOT appointment

- A SORN on a vehicle will remain valid until the vehicle is sold, taxed, exported or scrapped

Can I get temporary car insurance without a main policy?

Yes you can get a temporary car insurance policy without having an underlying policy.

For example, you may have just purchased a new car and not have an annual insurance policy set up yet.

You could then purchase a temporary insurance policy to get it home or until you have the opportunity to search for a good deal on your main annual car insurance policy. You can get the exact amount of time you need as short as like, even by the hour!

Does temporary insurance cover you in the same way as annual policy?

Temporary car insurance provides a similar level of car insurance as a comprehensive UK car insurance policy, just for a shorter period of time. There could be elements within an annual car insurance policy that you wouldn't get on a temporary car insurance policy, for example, windscreen cover.

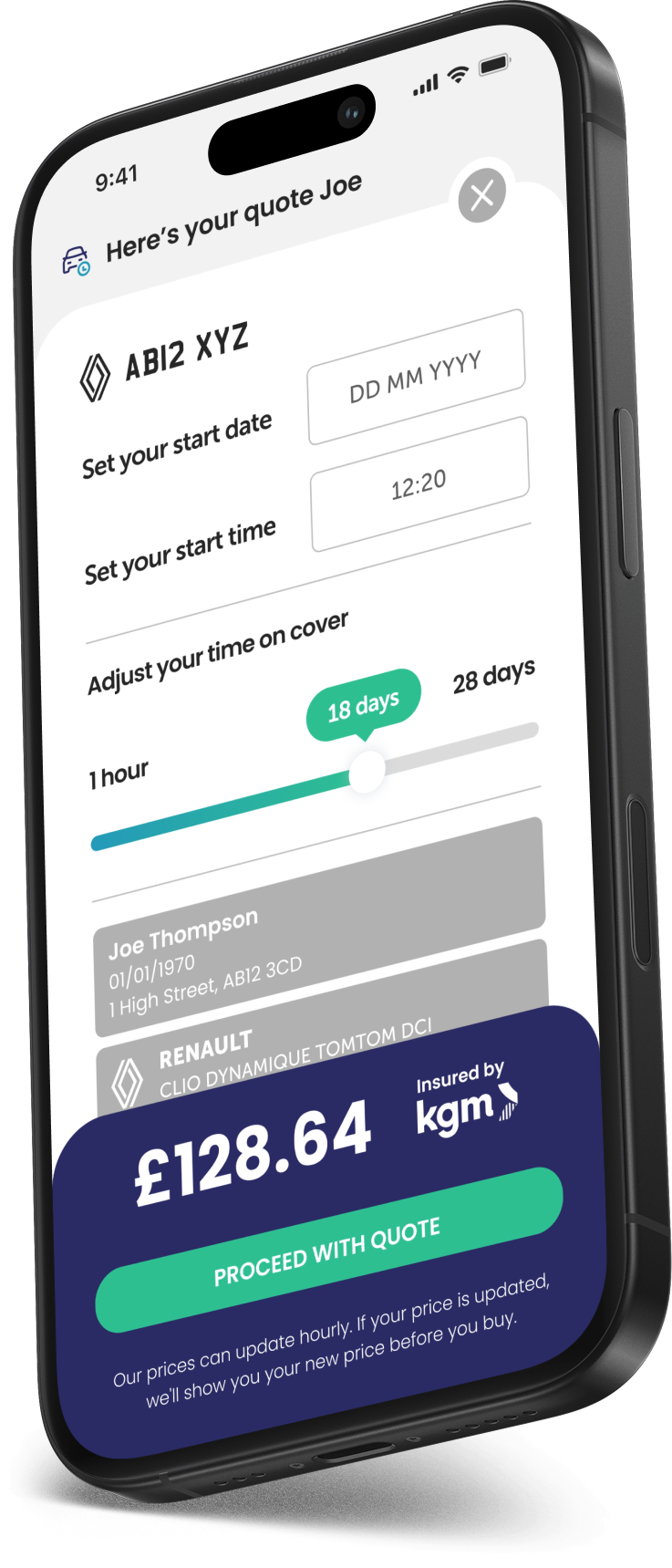

You can choose from one hour up to 28 days with the majority of temporary car insurance providers.

This is usually from one hour through to 12 hours in hourly increments, it then changes to daily increments past 12 hours.

You don't even need to own the car to get temporary insurance, non owner car insurance is another phrase often used for short term policies.

Short term insurance is entirely flexible, as you can select for your temporary car insurance to start as a very specific time and day within the next 30 days.

You can also take out multiple temporary policies per year, so if one short term policy runs out, you can simply add another to start immediately after it finishes to continue with your journey, fully covered!

However, if you're insuring the same car each time on a temporary basis, there will come a point at which an annual policy would be sensible.

Get a temporary insurance quote

Takes less than 60 seconds!

What is dual insurance?

Dual insurance is when the same car is insured twice with annual insurance policies at the same time.

It can lead to a few complications as not only are you paying for the same thing twice, it will cause confusion in the event of an accident or claim, as the two companies may not agree on who should pay the claim.

Temporary insurance will not have any impact on an existing annual policy and even if an annual policy is in place on a vehicle, you can take out a temporary policy on the same vehicle at the same time.

Can temporary insurance be classed as dual insurance?

Temporary car insurance is not classed as dual insurance, as it typically covers risks that differ from those insured by an annual policy.

If you are not listed as a named driver on a policy for the vehicle you intend to temporarily insure, it wouldn’t be considered dual insurance.

The purpose of temporary car insurance is to provide cover for a vehicle you personally, do not already have cover for.

Temporary insurance would therefore only be considered dual insurance if you took out temporary insurance on a car that you were a named driver on at the same time, so this needs to be avoided.

Did you know?

Not every Comprehensive car insurance policy allows you to Drive Other Cars; it must be mentioned specifically in your policy.