How to compare temporary car insurance

Temporary car insurance, also known as short term car insurance, is designed to give you flexible, comprehensive cover for as little as one hour up to 28 days.

Whether you need to borrow a car, insure as a non owner, share driving on a trip or use a car in an emergency, temporary insurance gives you the legal cover you need without the commitment of a full annual policy.

If you're thinking about buying short term insurance, it's always worth comparing your options.

Prices and features can vary between providers, so it's useful to understand what to look for and how to find the right fit for your needs.

Where to compare temporary car insurance

There are two main ways to compare temporary insurance policies:

Use a comparison website

A number of popular UK comparison websites allow you to look at temporary car insurance quotes from a range of providers. These sites let you enter your details once and receive a list of options based on the type of cover you need.

Comparison sites can be useful for getting a quick overview, but not every temporary insurer is listed on them. You may find the big names, but some newer or more specialist providers only sell policies directly.

Visit insurer websites individually

Another option is to go direct to each insurer that offers short term car cover. This takes a bit longer but gives you access to more providers, including those not listed on comparison sites. Some direct providers may offer better rates or simpler quote processes on their own websites.

It can be worth combining both approaches: check comparison sites to get a sense of the market, then see if any direct providers offer something different.

Insurers, brokers and comparison sites

What's the difference between these providers when buying temporary car insurance?

It’s easy to get confused about who’s actually providing what when it comes to comparing temporary car insurance. Here’s a quick breakdown of how it all works…

Insurers

An insurer is the company that underwrites your temporary policy. They take on the risk and are the ones who pay out if there’s an accident, theft or damage involving your vehicle.

Think of them like the car manufacturer; they build the product and take responsibility if something goes wrong.

Brokers

A broker offers policies from a range of different insurers.

They don’t provide the insurance themselves but work with multiple underwriters to find you a suitable deal. Think of them like a car dealership, they don’t build the cars, but they can offer you several options from different manufacturers.

Brokers often handle the setup of the policy, any changes during the cover period and customer service if you need help.

Comparison sites

Comparison sites are a step removed. They don’t directly sell the insurance or manage policies.

They simply make it easier for you to compare quotes from multiple brokers in one place. Think of them like the Auto Trader of the insurance world; a listing platform.

Once you choose a policy through a comparison site, you'll usually deal directly with the broker or insurer from that point on.

Get a temporary insurance quote

Takes less than 60 seconds!

Which comparison sites can you use for temporary car insurance?

There are a few well-known sites that allow you to compare temporary car insurance, but not all of them do. These are the comparison websites that actually compare temporary car insurance (ie not just redirect you to one single provider):

MoneySuperMarket

QuoteZone

What to look out for when comparing short term car insurance

Once you start comparing temporary insurance options, here are some of the key things to keep in mind:

Type of cover

Most temporary car insurance providers in the UK offer comprehensive cover as standard. This means you're covered for damage to your own vehicle, as well as third party damage and injury. It gives you peace of mind, especially if you're borrowing someone else's car.

Some providers may offer lower levels of cover such as third party or third party, fire and theft, but these are less common with temporary policies. Always check what level of protection you're actually getting before you buy.

Length of cover

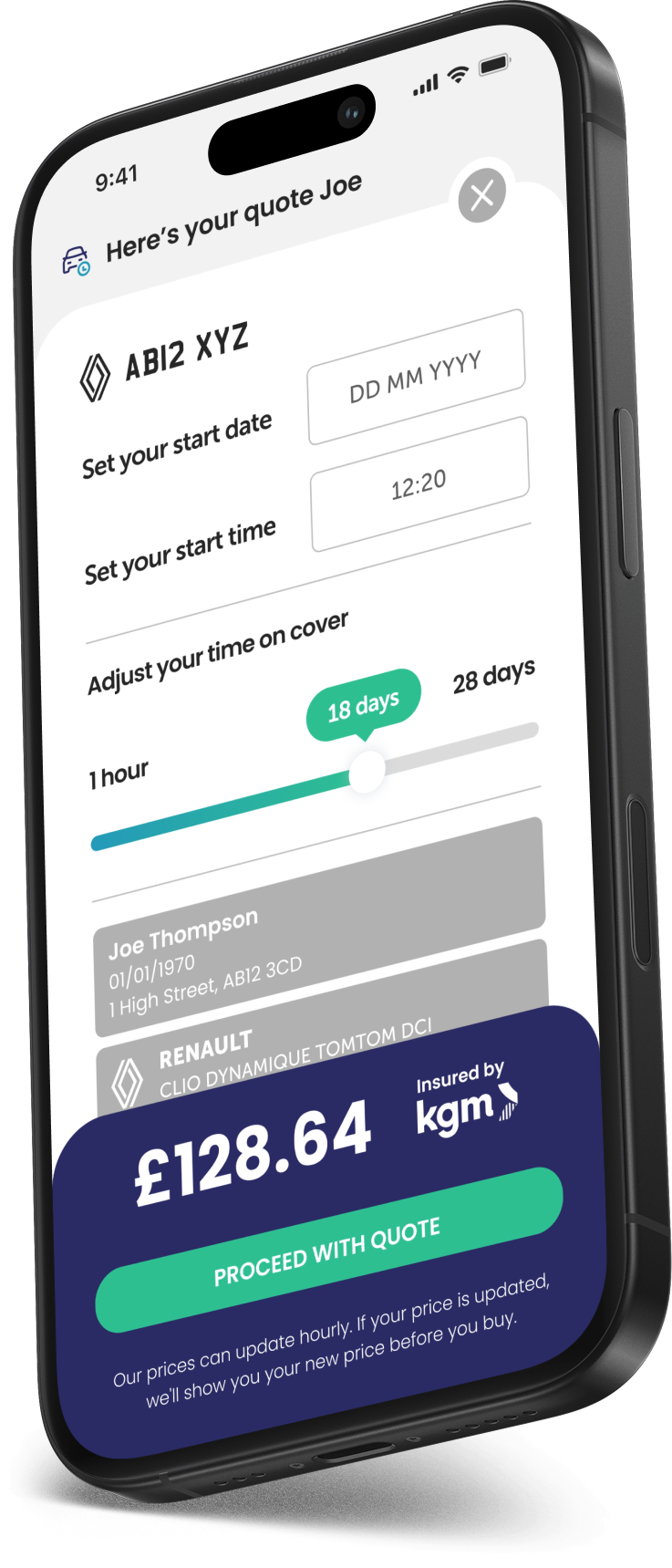

One of the main benefits of temporary insurance is flexibility. You can usually choose cover from as little as 1 hour to up to 28 days. Some providers offer longer, but you can also purchase another policy as soon as one policy runs out, meaning you can insure for much longer than 28 days with any provider if you so wish!

When comparing short term car insurance look at how easy it is to customise the length of time you need. Some insurers only offer daily policies, while others allow you to tailor the time right down to the hour.

Purpose of use

Not all policies cover the same types of driving. Make sure you select the right "class of use" when getting a quote:

Social, Domestic and Pleasure (SDP): for everyday driving like going to the shops or visiting friends

SDP and Commuting: includes travel to and from a regular place of work or study

Personal Business Use: covers additional travel during work hours, such as driving to meetings or multiple work related locations

Excess amount

Excess is the amount you agree to pay towards a claim. With temporary insurance, the excess is usually fixed, unlike annual policy where you can tweak your voluntary excess payment up and down. Your compulsory excess cannot do this, as it’s a compulsory part of any claim.

When comparing policies, make note of the excess amount. A cheaper policy with a higher excess might not be the best deal if you ever need to claim.

Age and licence restrictions

Some providers only insure drivers over 21 or 25, while others offer cover from age 17 if you have a valid UK licence or provisional.

Always check the minimum age and licence requirements when comparing, especially if you're a younger or learner driver. Make sure your provider covers you and what you need to use the car for.

Vehicle types and value limits

Most temporary car insurance providers have restrictions on the type of vehicle they cover. Common exclusions include:

Very high value cars

Modified vehicles

Cars used for hire and reward (like taxis or delivery work)

Make sure your car is eligible for cover before purchasing any insurance policy.

Is it worth paying more for better service?

While price is important, don't overlook the value of good service. Some insurers offer 24/7 support, live chat or quick document delivery by email. If you're in a hurry to get on the road, fast and simple service can make a real difference.

Look out for reviews on sites like Trustpilot or Google to see how real customers rate each provider. Make sure sure you can select the exact duration you need to help bring your price down, from one hour, 24 hours, one day, one week all the way up to 28 days.

Temporary car insurance comparison tips

Here are a few final pointers to help you get the best from your short term insurance search:

Know exactly when you need cover: Start and end times can be chosen to the minute with some insurers, so plan ahead.

Be accurate with your details: Temporary cover is based on the specific driver and vehicle. Mistakes could invalidate your insurance.

Check for admin fees: Some providers charge extra to cancel or amend your policy, even if it's only a day long.

Keep your documents handy: You'll usually receive your insurance certificate by email within minutes, but make sure you can access it quickly if needed.

Compare short term car insurance

Comparing temporary car insurance is about more than just finding the cheapest price. It's about understanding what you’re actually getting for your money, how flexible the cover is and whether it fits your driving plans.

Whether you need to borrow a car for a few hours, get extra time behind the wheel as a learner, or sort last-minute cover for a weekend trip, a short term policy can be a cost-effective and practical solution.

By taking the time to compare options and check the small print, you can find the temporary car insurance that’s right for you and get on the road with full peace of mind.

Did you know?

Comparing multiple temporary insurance providers could help you find your cheapest available short term cover.